B2Prime Evolution: Increased Regulation, Enhanced Liquidity, Improved Website

Disclaimer: The text below is a press release that is not part of Cryptonews.com editorial content.

As a global liquidity provider, B2Prime is devoted to setting new industry standards and satisfying client needs flawlessly. Their most recent quality upgrade introduces enhanced regulatory compliance, additional liquidity options and upgraded leverage packages. With these high-profile strategic improvements, B2Prime has also introduced a re-designed website. Let’s explore B2Prime’s most recent overhaul in greater detail.

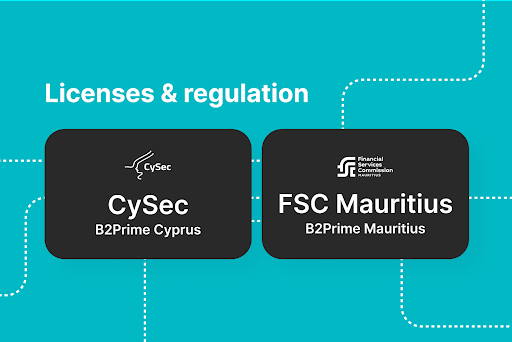

Elevating Regulatory Compliance

B2Prime values the significance of flawless regulatory compliance in building trust with their customers. They have taken significant steps to fortify the regulatory framework to emphasise their commitment to compliance.

B2Prime Cyprus (CySec)

B2Prime Cyprus jurisdiction is designated for institutional participants and large corporate clients in the European region. Brokers in Europe, including those in Cyprus, can now utilise the services of an EU-regulated liquidity provider, which offers a generous selection of crypto CFD pairs and other high-level instruments like NDFs and natural gas. Additionally, B2Prime’s Cyprus branch can service clients from numerous 3rd world countries, including Malaysia, the Cayman Islands, Hong Kong, India, Indonesia, Kuwait, and Vietnam. The complete list of supported countries is available here.

B2Prime Mauritius (FSC Mauritius)

On the other hand, B2Prime Mauritius will service the institutional and corporate clients outside of the European region. Settlements to the margin account, including platforms like OneZero and Prime XM, now support fiat (EUR/USD) and digital currencies (major coins + stablecoins) for deposits and withdrawals. The B2Prime Mauritius is a perfect option for brokers who desire thoroughly regulated liquidity providers that are transparent and prove their compliance effortlessly. Mauritius also enables users to deposit digital currencies for initial settlements. Thus, licensed brokers in Mauritius can enjoy working with a fully regulated LP, giving them access to various high-level crypto mechanisms, including crypto CFD, NDF CFDs, and other CFD assets.

Both B2Prime Cyprus (CySec) and B2Prime Mauritius (FSC Mauritius) operate on a single website and have a similar operating structure, enabling corporate clients to select a perfect option for their specific needs seamlessly.

Enhanced Liquidity Options

B2Prime has further deepened its pool of multi-asset liquidity options, all available through a client margin account. The highlight of new offerings is the 24/7 streaming liquidity for 93 crypto CFD pairs. The liquidity options can be obtained via FIX API on well-established platforms, including OneZero and PXM. B2Prime now offers a 10% margin on all major crypto pairs, an unprecedented liquidity option across the entire Eurozone.

Here’s the comprehensive list of B2Prime’s liquidity options:

B2Prime’s offering of NDFs as CFDs is a significant achievement, as it is a rare option in the liquidity provider market. Combined with the rest of the liquidity offerings, B2Prime has now become one of the most comprehensive liquidity providers on the European market.

In addition, B2Prime offers lower margin requirements on ten crypto CFD instruments in their portfolios. Clients can now control larger trading positions with much lower capital requirements and execute their ambitious strategies with limited budgets. Furthermore, B2Prime’s aggregation approach ensures they offer the market’s most outstanding spreads, and their financing charges remain unparalleled in the industry.

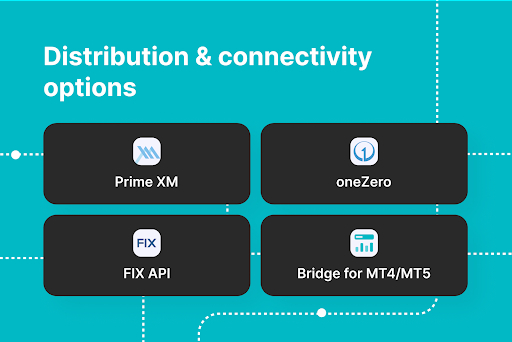

Renewed Distribution Methodology

Naturally, the scope and scale of B2Prime’s distribution require state-of-the-art technology. B2Prime now features cutting-edge tech vendors like OneZero and Prime XM, available to clients on demand. Additionally, any FIX API-compatible solution can now be enhanced with B2Prime’s liquidity.

Clients that use the MetaTrader platform can now access Bridge Gateways for MT5 and a Bridge Plugin for MT4. Both platforms are available through either native OneZero/PXM solutions or via Hub-to-hub connections for clients that already possess a Trading Liquidity Hub.

Moreover, B2Prime has now integrated with several highly reputable platforms, including cTrader, Centroid HUB, T4B Trading engine, YourBurse Hub, and FxQubic. With such robust capabilities, clients can start operating a prime margin account after finishing up with the onboarding. The process also accommodates the whitelisting of IP addresses and accessing all tradable pairs on the platform.

Near-Unprecedented Margin Requirements

B2Prime has kept up with evolving trading needs and requirements, offering highly competitive margin requirements and accessible pricing to its clients.

Here’s the updated summary of requirements:

- Prime Margin Account setup: Free of charge.

- The monthly minimum liquidity fee is $1,000 (includes one FIX API connector or Hub to Hub connector).

- Optional MT Gateway/Bridge monthly fee: $1,000.

- Minimum account deposit: $10,000, which can be used for trading.

The above-outlined commissions will be offset with USD/EUR monthly commission in correspondence with the traded volume.

To explore B2Prime’s commissions further, please leave a request here.

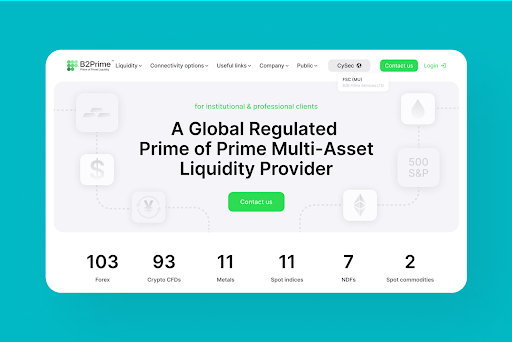

Major Additions to B2Prime Website

B2Prime’s new website is more accessible, allowing users to navigate freely and conveniently. The following updates were implemented to enhance the user experience across the board:

- Visual Air Reduction – The entire B2Prime website is now cleaner and less cluttered with extra tabs and visual distractors.

- Compact Blocks – All blocks are now optimised, and the essential data is presented concisely.

- Location-Based Redirection – The B2Prime website now automatically redirects visitors based on their physical location, providing a more personalised experience.

- Header & Footer Revamp – Upgraded header and footer sections allow users to navigate through the website seamlessly.

These changes result in a smoother and more optimal user experience.

A New Chapter for B2Prime

With dramatic upgrades outlined above, B2Prime has become a tier-1 regulated liquidity provider. B2Prime offers 93 crypto CFD offerings with 24/7 availability and 10% leverage for major currencies. The overhauled website UI further simplifies brokerage activities for B2Prime’s clients.

Interested to see and hear more? B2Prime will showcase its additions and upgrades at the IFX Cyprus Expo, delving into more detail about its enhanced functionalities and offerings.