Argentina’s Crypto ‘Awareness’ Hits 75%, Study Finds

Argentina’s crypto “awareness” levels have risen to 75%, a new study has found, although many citizens say they are still wary of token “volatility.”

Per Criptonoticias, the study was carried out by Bitso, one of the largest and busiest crypto trading platforms in the LATAM region.

The exchange surveyed 1,243 people throughout the capital Buenos Aires and all 23 provinces of the country in mid-June this year.

The researchers noted that just over 15% of respondents said they did not know anything about crypto.

But over 34% of Argentinians said they had at least “heard about” crypto, with 45% saying they “know what cryptocurrencies are.”

Crypto “awareness” was highest among teenagers and people in their 20s: 90% of people aged 16-29 said they knew what crypto was, or were familiar with the ins and outs of trading coins.

But this high level of crypto knowledge may not be translating into adoption, as the responses reportedly “point to a high level of mistrust in the sector.”

About 53% of the respondents said they had “little or no confidence in cryptocurrencies,” with only 8.5% saying they had either “total” or “high levels of confidence” in the future of crypto.

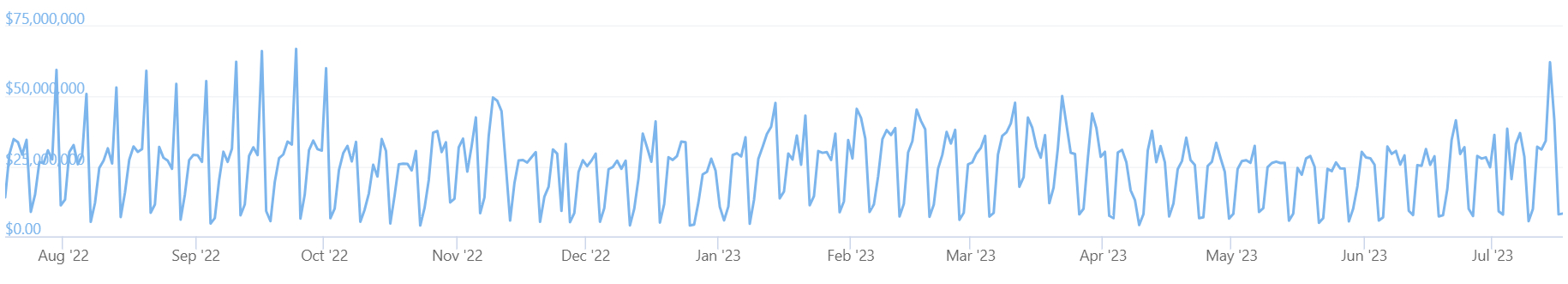

Bitso researchers claimed that these low levels of confidence were probably related to the volatility of cryptoassets and the effects of a prolonged crypto winter.

Argentina: Crypto ‘Awareness’ Rising Fast?

A May study conducted by Consenys and YouGov saw researchers speak to just over 1,000 Argentines aged 18-65.

This study found that more than 90% of people in the nation have heard of cryptoassets.

A third of respondents in the May survey said that they either held tokens at the time of the survey or had traded coins in the past.

With inflation still on the rise in Argentina, some have suggested binning the fiat peso in favor of adopting the US dollar.

But some have suggested doing away with dollarization plans in favor of Bitcoin (BTC) adoption.

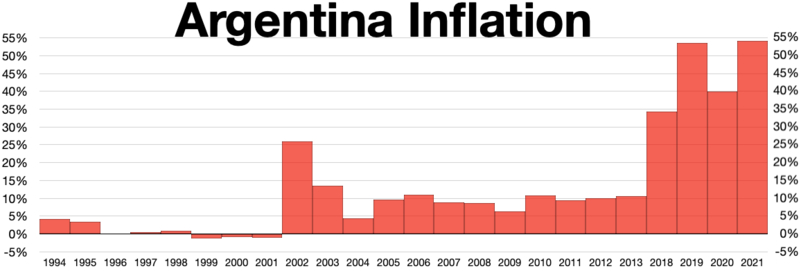

Inflation is not a new phenomenon in Argentina: The nation has been plagued by spiraling rates in the past two decades, but the peso has been in freefall since 2018.

Regulators, meanwhile, have been accelerating plans to introduce stricter regulation of the crypto sector as adoption rises in the nation.