Best Crypto to Buy Now 28 July – ImmutableX, Internet Computer, Ethereum Classic

On July 27, Grayscale presented an argument on the approval of Bitcoin ETFs to the SEC, amid growing pressure for their approval from a growing user base.

Grayscale argued that approving all applications concurrently would ensure a level playing field, without any one fund having an early edge.

Considering this developing macroeconomic situation, what are the best cryptos to buy now?

The proposal, delineated in a letter to the SEC, comes from Craig Salm, Chief Legal Officer at Grayscale.

The thrust of the communication concerns eight Bitcoin ETF filings, inclusive of Grayscale’s own application.

With this move, Salm is challenging the SEC to refrain from designating “winners and losers” but rather to bring about an unbiased and orderly resolution.

The proposition maintains that the SEC could sanction the ETFs based on the precedent set by its approvals for Bitcoin futures ETFs, drawing a strong correlation between the two fund types.

Eagerly awaiting the SEC’s green light on their ETF applications are Invesco, BlackRock, Valkyrie, VanEck, Wisdom, Fidelity, and ARK Invest, who have recently included SSAs in collaboration with Coinbase in their amended applications.

Paralleling the tension in the ETF arena, political discourse around stablecoin regulations has also heightened.

Patrick McHenry, a Republican Congressman leading the United States Financial Services Committee, has expressed disappointment with the Biden administration, attributing the delay in the implementation of stablecoin regulations to their reticence.

McHenry’s grievances were aired during a hearing on July 27, where he underscored the absence of consensus between his party and the Democrats, especially with respect to the Clarity for Payment Stablecoins Act.

McHenry has criticized the Democrats for lacking the urgency necessary to arrive at a common ground on stablecoin legislation, asserting that the White House’s reluctance to concede has essentially brought negotiations to a standstill.

On the other side of the aisle, Maxine Waters, a ranking committee member, faults the “precipitation of Republican leadership” for the failure to reach an agreement on the legislation.

While the crypto space watches the drama surrounding the Clarity for Payment Stablecoins Act unfold, other crypto-related bills are making their way through the legislative process.

On July 26, lawmakers endorsed two significant crypto bills by voting for the Financial Innovation and Technology for the 21st Century Act and the Blockchain Regulatory Certainty Act.

The approval of these two acts showcases the legislators’ acknowledgment of the potential role of cryptocurrencies and blockchain technology in shaping the future of finance.

However, the controversy surrounding stablecoin regulation and the SEC’s decision on Bitcoin ETFs will undoubtedly have substantial implications for the future direction of the cryptocurrency market.

Thanks to their solid fundamentals and positive technical outlooks, ImmutableX, BTC20, Internet Computer, Chimpzee, and Ethereum Classic are some of the best cryptos to buy now.

Immutable X (IMX) Experiences Short-Lived Spike as Buying Momentum Wanes

Immutable X (IMX) caught the attention of traders today, exhibiting a promising surge from the Fib 0.618 support level, reaching an intraday high of $0.85.

This impressive performance, not seen for several months, represented a decisive break above the 10-day EMA and the crucial Fib 0.786 resistance pegged at $0.7800.

However, as the trading session continued, this elation was short-lived.

The buying momentum that had propelled IMX to its earlier highs began to wane, pulling the cryptocurrency back to a slightly more modest level of $0.7546.

This represents a modest 3.54% appreciation so far today but also means IMX re-enters the familiar Fib 0.5 to 0.786 trading range that dominated its price action over the preceding 35 days.

When gauging the long-term sentiment of IMX, the EMA provides some key insights.

The 20-day and 50-day EMAs, both hovering around $0.7320, serve as immediate support, potentially reinforcing the strength of the Fib 0.618 level.

Intriguingly, the convergence of these two EMAs could be indicative of a strong support zone.

Traders should keep an eye on the 100-day EMA, currently at $0.7700, as it represents the immediate overhead resistance.

The Relative Strength Index (RSI) has shown a slight bullish uptick, moving from 50.48 to 55.60. While not in the overbought territory, this suggests a modest increase in buying pressure.

Additionally, the MACD histogram’s movement from -0.0028 to -0.0007 signals a potential bullish crossover in the near future, further reinforcing the positive momentum observed.

One cannot overlook the dramatic 1200.38% surge in 24-hour trading volume, reaching a remarkable $180 million.

Coupled with the market cap’s 3.88% ascent to $816 million, these metrics shed light on the heightened trader interest and significant trading activity surrounding IMX this week.

Considering the technical indicators, traders should be vigilant of the immediate resistance posed by the 100-day EMA at $0.7700, with the subsequent hurdle at the Fib 0.786 level of $0.7800.

On the flip side, the Fib 0.618 level at $0.7320, flanked by the 20-day and 50-day EMAs, offers a robust support zone.

While today’s rally was indeed promising, it’s paramount for traders to watch the aforementioned technical levels closely.

The immediate future will reveal whether IMX can maintain this momentum and establish a solid foothold above its recent resistance or if it will once again be confined within its familiar trading range.

BTC20 Presale Raises Over $4 Million: One of the Best Cryptos to Buy Now

Cryptocurrency enthusiasts are eager about BTC20, an ERC-20 token that runs on the Ethereum blockchain.

This cryptocurrency is highly attractive to investors due to its unique proposition of providing “Bitcoin on Ethereum” at the 2011 Bitcoin price of $1. Many investors consider it to be one of the best cryptos to buy now.

BTC20 has made significant strides, exceeding $4 million in its presale in only ten days, which is a testament to the high demand for the token.

According to Google Trends data, BTC20 has been gaining more interest than Pepe coin and Bitcoin in certain instances, particularly in Europe.

This enthusiasm is stoked not just by the nostalgic pricing but also by BTC20’s considerable yield potential.

The allure of BTC20 extends to its eco-friendly attributes attributed to its Ethereum foundation, contributing to the increasing interest.

A quote from an anonymous investor reveals, “The concept of buying ‘Bitcoin on Ethereum’ at the original Bitcoin’s 2011 price is quite enticing, and the potential benefits are difficult to ignore.”

BTC20 is not only about retro charm; it will offer a passive income opportunity for its holders.

It replicates Bitcoin’s issuance schedule, rewarding BTC20 owners who stake their tokens instead of miners. Depending on the staking pool size, yields could be extraordinarily high.

Other advantages include BTC20’s eco-friendliness as a token on the Ethereum blockchain and access to the robust DeFi ecosystem of Ethereum.

This flexibility positions BTC20 as an attractive investment proposition, evident in the escalating presale numbers.

Visit BTC20 Now

Internet Computer’s (ICP) Growing Trading Volume Signals Increasing Demand Amid Bullish Momentum

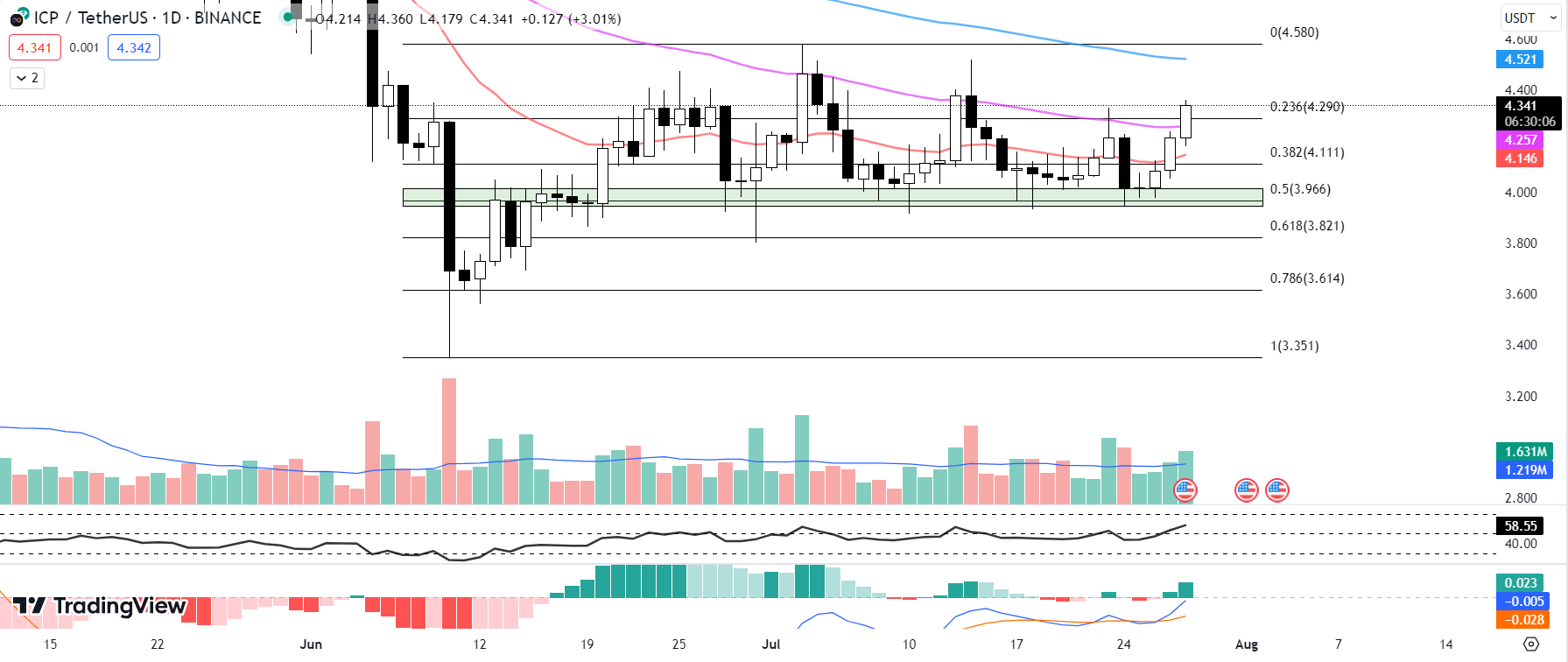

Internet Computer (ICP) continues to show promising signs as it enters its third consecutive day of positive price action.

The cryptocurrency is currently challenging the Fib 0.236 level at the 50-day EMA, a critical juncture that could indicate a breakout trend.

This comes as the trading volume has been on a steady incline, creating a bullish atmosphere around the cryptocurrency.

The 20-day EMA currently stands at $4.146, while the 50-day and 100-day EMAs are at $4.257 and $4.521, respectively.

The current price of ICP is $4.341, which lies above the 20-day EMA and 50-day EMA, suggesting that the bulls are in control of the market trend.

Further adding to this bullish outlook is the RSI which has increased to 58.55 from yesterday’s 53.47.

The RSI is a momentum oscillator that measures the speed and change of price movements.

An RSI value above 50 suggests that the asset is in a bullish phase, with the current RSI indicating that buyer momentum is increasing.

The MACD histogram is also up from yesterday’s 0.009 to 0.023. This upward trend in the MACD histogram indicates that the bullish momentum is strengthening, hinting at a continuation of the upward trend.

The market capitalization of ICP is up by 5.77% to $1.9 billion, reflecting growing investor interest in the cryptocurrency.

Additionally, the trading volume for the past 24 hours has increased by a substantial 68.30% to $31 million, further emphasizing the increasing demand for ICP.

The immediate resistance ICP faces lies at the 100-day EMA of $4.521, followed by the range high of $4.58 set earlier this month on July 3.

If ICP can break past these levels, it would confirm the bullish outlook and potentially trigger a new surge in price.

On the flip side, immediate support can be found at the Fib 0.236 level at $4.29, followed by the 50-day EMA at $4.257.

These levels will be crucial in maintaining the current bullish momentum. If the price drops and these support levels hold, it could provide an ideal entry point for new buyers, while also offering strong reassurance to current holders.

The technical indicators for Internet Computer (ICP) paint a positive image of the cryptocurrency’s immediate future.

The upward trend in price, coupled with growing trading volume and strengthening technical indicators, suggests a continuation of the bullish momentum.

However, traders are urged to monitor the resistance and support levels closely and react accordingly to maintain a balanced risk-reward ratio.

Looking for a Crypto with a Mission? Chimpzee is One of the Best Cryptos to Buy Now

Chimpzee is not just a crypto platform; it’s a movement. With the project’s presale gaining traction, the development team is focused on bringing Chimpzee’s ecosystem vision to reality.

Chimpzee’s reputation as a green crypto platform is reinforced by its ongoing support for environmental charitable causes.

The platform recently donated $20,000 to the WILD Foundation, reinforcing its support for wildlife conservation.

Prior to this, the Chimpzee community planted 1,200 trees in Brazil and 20,000 trees in Guatemala and donated $15,000 for elephant conservation.

Meanwhile, the upcoming Chimpzee store offers glimpses of potential merchandise.

Part of the store’s profits will be channeled to listed charities, making shopping a rewarding and charitable act.

Every purchase will earn the shoppers $CHMPZ tokens, turning the platform into a shop-to-earn and shop-to-donate experience.

The presale’s conclusion will usher in the next phase of Chimpzee’s development, focusing on the shop’s launch, the NFT minting platform, and the staking engine.

Later roadmap phases include the development of the NFT marketplace and a play-to-earn game, underlining Chimpzee’s commitment to continuous growth and charity.

Visit Chimpzee Now

Ethereum Classic: Potential for Bullish Energy Held Back by Resistance

Ethereum Classic (ETC) has been capturing attention recently with its series of green days, but the price’s interactions with several key moving averages present an intricate picture.

Traders must navigate this complex scenario with a keen eye on the provided technical indicators to gauge potential near-term moves.

Starting with the EMAs, ETC’s recent surge saw it attempt a breakthrough of not just one but three critical levels: the 20-day, 50-day, and 100-day EMAs.

Such moves often indicate a potent bullish signal, suggesting a potential trend reversal. The intraday high of $18.85 was a testament to this strength.

However, the subsequent inability to sustain above these levels and retract to a current price of $18.49 shows evident selling pressure.

This highlights the immediate resistance faced at the 50-day EMA of $18.48. But with the 20-day and 100-day EMAs closely aligned at $18.61 and $18.66 respectively, they form a tight band of resistance.

This confluence zone may make it challenging for ETC to register a significant breakout in the immediate future.

The RSI stands at 48.84, up slightly from yesterday’s 47.71. This reading below 50 indicates a slight bearish bias. However, the marginal increase hints at a potential equilibrium between buying and selling pressure.

Additionally, the MACD histogram is currently at -0.10, which improved slightly from the previous day’s -0.13.

This change shows that bearish momentum is gradually reducing, but we’re not in bullish territory yet.

Interestingly, the current price is sandwiched between the immediate resistance presented by the trio of EMAs and the solid support of the Fib 0.5 level at $17.95.

If the bearish hammer candlestick is confirmed by the close of the day, it adds to the warning signs for potential buyers.

Ethereum Classic’s recent price behavior paints a picture of potential bullish energy held in check by significant resistance.

With the EMAs forming a tight resistance cluster and technical indicators offering mixed signals, traders are advised to proceed with caution.

Breaking above this resistance cluster could pave the way for more extended bullish runs.

Conversely, a failure could see ETC retest the Fib 0.5 support level. As Ethereum Classic hovers in limbo between support and resistance, traders must stay alert, implement robust risk management, and adjust strategies accordingly.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.