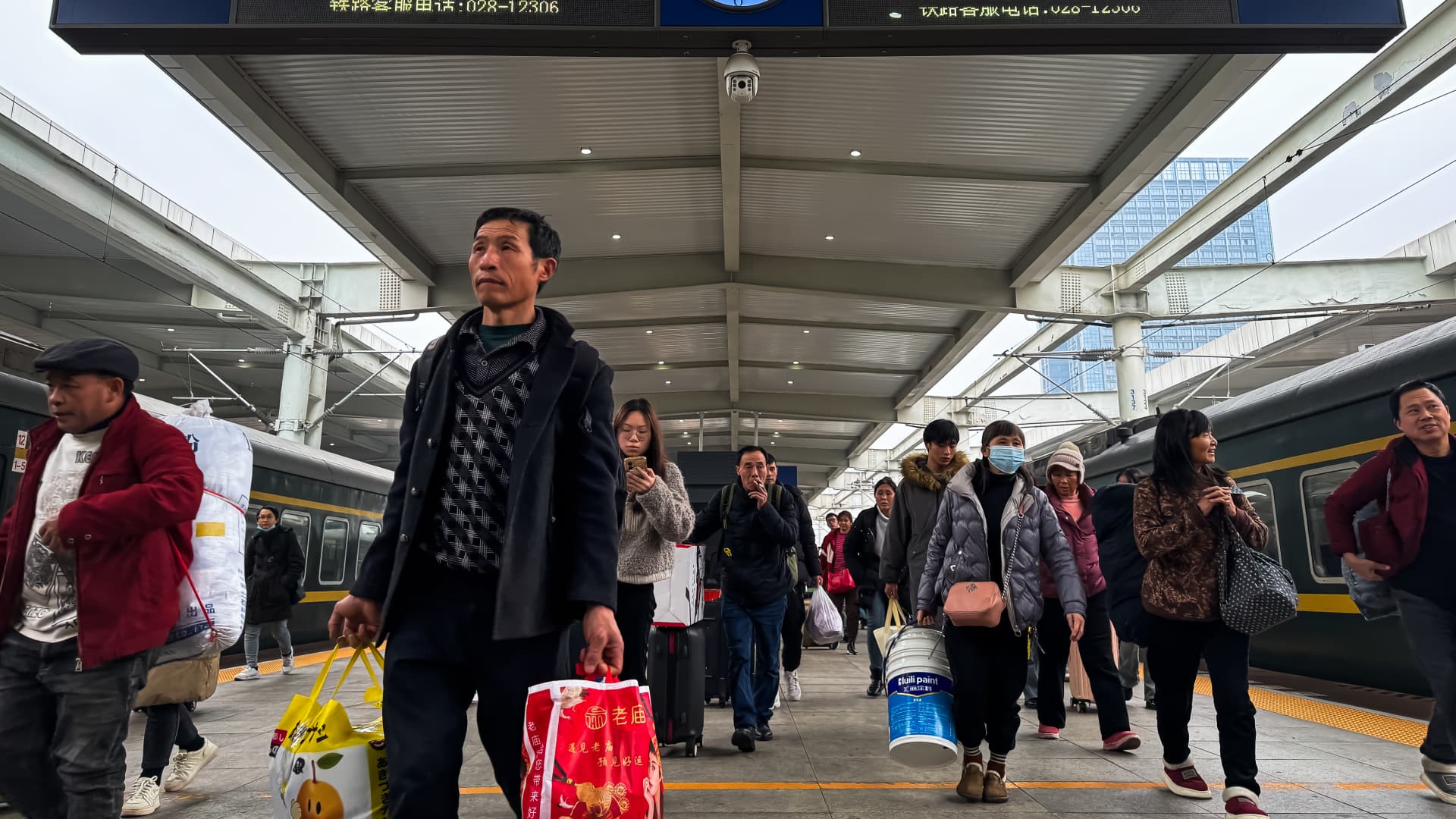

Passengers walk along the platform after disembarking from a train at Chongqing North Railway Station during the first day of the 2025 Spring Festival travel rush on Jan. 14, 2025.

Cheng Xin | Getty Images News | Getty Images

BEIJING — As promised government support is still to meaningfully kick in, China’s economy hasn’t yet seen the turnaround investors have been waiting for.

While policymakers have, since late September, cut interest rates and announced broad stimulus plans, details on highly anticipated fiscal support won’t likely come until an annual parliamentary meeting in March. Official GDP figures for 2024 are due Friday.

“China’s fiscal stimulus is not yet enough to address the drags on economic growth … We are cautious long term given China’s structural challenges,” BlackRock Investment Institute said in a weekly report Tuesday. The firm, which is modestly overweight Chinese stocks, indicated it was ready to buy more if the circumstances changed.

Of growing urgency in the meantime is the drop in domestic demand, and worries about deflation. Consumer prices barely rose in 2024, up by just 0.5% after excluding volatile food and energy prices. That’s the slowest rise in at least 10 years, according to records available on the Wind Information database.

“Consumer spending remains weak, foreign investment is declining, and some industries face growth pressure,” Yin Yong, Beijing city mayor, said Tuesday in an official annual report.

The capital city targets 2% consumer price inflation for 2025, and aims to bolster tech development. While nationwide economic goals won’t come out until March, senior economic and finance officials have told reporters in the last two weeks that fiscal support is in the works, and issuance of ultra-long bonds to spur consumption would exceed last year’s.

China’s announced stimulus will begin to take effect this year, but it will likely take time to see a significant impact, Mi Yang, head of research for north China at property consultancy JLL, told reporters in Beijing last week.

Pressure on the commercial property market will continue this year, and prices may accelerate their drop before recovering, he said.

Rents in Beijing for high-end offices, called Grade A, fell 16% in 2024 and are expected to drop by nearly 15% this year, with some rentals even nearing 2008 or 2009 levels, according to JLL.

New shopping centers in Beijing opened in 2024 with average occupancy rates of 72% — previously such malls would not be opened if the rate was below 75% or much closer to 100%, JLL said. Within a year, however, the new malls have seen occupancy rates reach 90%, the consultancy said.

Home appliances

Unlike the U.S. during the Covid-19 pandemic, China has not handed out cash to consumers. Instead, Chinese authorities in late July announced 150 billion yuan ($20.46 billion) in ultra-long bonds for trade-in subsidies and another 150 billion yuan for equipment upgrades.

China has already issued 81 billion yuan for this year’s trade-in program, officials said this month. It covers more home appliances, electric cars and an up to 15% discount on smartphones priced at 6,000 yuan or less.

Consumers who buy premium phones tend to upgrade and recycle their devices more frequently than buyers on the lower end of the market, indicating the government may want to encourage a new group to shorten their upgrade cycle, said Rex Chen, CFO of ATRenew, which operates stores for processing smartphones and other secondhand goods.

Chen told CNBC on Monday he expects the trade-in subsidies program can boost recycling transaction volumes of eligible products on the platform by at least 10 percentage points, up from 25% growth in 2024. He also expects the government to carry out a similar trade-in policy for the next few years.

However, it’s less clear whether the trade-in program alone can lead to a sustained recovery in consumer demand.

Nomura’s Chief China Economist Ting Lu said in a report Tuesday that he expects the sales boost to fade by the second half of this year, and that tepid new home sales will limit demand for home appliances.

Real estate

Real estate and related sectors such as construction once accounted for more than a quarter of China’s economy. When central authorities started cracking down on developers’ high debt levels in 2020, that had ripple effects on the economy, alongside the Covid-19 pandemic.

China shifted its stance on real estate in September following a high-level meeting led by President Xi Jinping that called for halting the sector’s decline.

Measures to prop up the sector include using a whitelist process to finish construction on the many apartments that have been sold but yet not been built due to developers’ financial constraints. New apartments in China are typically sold ahead of completion.

Jeremy Zook, lead analyst for China at Fitch Ratings, said the real estate market had yet not reached a bottom, and that authorities might provide more direct support. He pointed out that it was difficult for the economy to transition away from real estate, despite China’s wishes to reduce its reliance on the sector for growth.

The government’s latest measures have helped the broader stock market rally, and lifted sentiment slightly.

Sales of new homes in China’s largest cities over the last 30 days have surged by nearly 40% from a year ago, Goldman Sachs analysts said in a Jan. 5 report.

But they cautioned that high inventory levels in smaller cities indicate property prices “have further room to fall” and that homebuilding is “likely to remain depressed for years to come.”

In the relatively affluent city of Foshan — near Guangzhou city in southern China — housing inventory could take 20 months to clear in one district, and seven months in another district, according to a 2024 report from Beike Research Institute, a firm affiliated with a major housing sales platform in China.

The city overall saw floor space sold last year fall by 16% to the lowest in 10 years, the report said.

Geopolitical concerns

Complicating China’s economic challenges are tensions with the U.S. Similar to Washington’s export controls, Beijing has also made efforts to ensure national security by prioritizing domestic players in strategic sectors such as technology.

That stance has pressured an increasing number of European businesses in China to localize — despite added costs and reduced productivity — if they are to retain customers in the country, the EU Chamber of Commerce in China said in a report last week.

Official Chinese statements have also emphasized coupling security with development.

A slogan for part of Beijing’s efforts to support growth is an effort to build “security capabilities in key areas,” pointed out Yang Ping, director of the investment research institute within the National Development and Reform Commission. She was speaking at a press event Wednesday.

This year, “boosting consumption has been prioritized ahead of improving investment efficiency,” Yang said in Mandarin, translated by CNBC. “Expanding and boosting consumption are the main focus of this year’s policy adjustment.”

She dismissed concerns that the impact of trade-in subsidies on consumption would fade after an initial spike, and indicated more details would emerge after the March parliamentary meeting.