Bitcoin Price Prediction – Will the Market Stabilize or Continue to Plummet Below $25,000?

Bitcoin has been experiencing a significant drop in value over the past few weeks, causing many investors and analysts to speculate about the future of the cryptocurrency market. As the world’s largest digital currency, Bitcoin has a significant impact on the broader cryptocurrency market, and its movements are closely monitored by traders and investors.

With the recent market instability, the question on everyone’s mind is whether Bitcoin will stabilize or continue to plummet below the $25,000 level. In this article, we will explore the current state of the Bitcoin market and provide a price prediction for the near future.

Uncertainty in US Crypto Regulation and its Impact on Bitcoin (BTC)

After experiencing a significant sell-off during the weekend, cryptocurrency prices started the new week with losses. The reason behind this can be attributed to the increasing regulatory scrutiny faced by crypto-related businesses in the United States, coupled with regulatory uncertainty.

This recent crackdown on cryptocurrencies by the US government has led to a sharp decline in the price of BTC/USD. Recently, the CEO of Coinbase, Brian Armstrong, hinted that the cryptocurrency exchange might relocate from the US if there is no change in the legal environment.

Armstrong expressed his frustration with the unclear regulations for the cryptocurrency sector in the US, where different government agencies have differing opinions on how to categorize and control digital assets. He mentioned that he would prefer to do business in a country like the UK, where only one regulator takes a uniform approach.

On April 24th, Coinbase filed a lawsuit asking the US SEC to respond to their earlier request for rulemaking to clarify cryptocurrency restrictions. The digital currency exchange had submitted the petition and an extensive list of inquiries to the regulatory body in July of last year.

According to Chamath Palihapitiya, a Bitcoin bull and billionaire tech investor, US policymakers have effectively strangled the cryptocurrency industry to death.

US Economic Indicators Weigh

On April 24, Monday, the Federal Reserve Bank of Dallas released the Dallas Fed Manufacturing Index report, which revealed that the index had dropped from -15.7 in March to -23.4 in April, below the analyst consensus of -14.6. The survey shows that the ratings of the state of the economy have significantly declined in April.

Meanwhile, investor sentiment regarding the Federal Reserve’s monetary policy shifted towards a more hawkish stance as economic data remained weak.

On Tuesday, the probability of a 25-basis-point interest-rate hike in May rose to 84%, according to the CME FedWatch Tool. Additionally, the likelihood of an increase in June also went up to 24.7%.

As a result of speculation regarding another rate hike, the Dollar Index (DXY) slightly gained, rising 0.02% to trade at 101.37. Overall, increased risk aversion and indicators of a weak US economy have led to a decline in BTC/USD prices.

Bitcoin Price

Bitcoin is currently trading in the $27,200 to $27,823 range. Technical indicators such as the RSI and MACD indicate a selling bias, but also a possible uptrend in Bitcoin’s price. If Bitcoin falls below $27,200, it may fall to the next level of support at $26,665, or even to $26,000 or $25,600.

If demand for Bitcoin rises, it may break through the $27,800 resistance level and reach $28,260 or $28,820.

Investors should keep an eye on this range to determine future price movements. Economic events such as CB Consumer Confidence and New Home Sales in the United States can also have an impact on Bitcoin prices.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

Traders seeking profits have started exploring other cryptocurrencies as Bitcoin’s recovery may take some time. The market offers various promising options, including newer altcoins and presale tokens, that present potential for decent gains.

As a result, the Cryptonews Industry Talk team has curated a list of the top 15 cryptocurrencies for 2023, each with good prospects for both the short-term and long-term.

The list is frequently updated with new altcoins and ICO projects.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

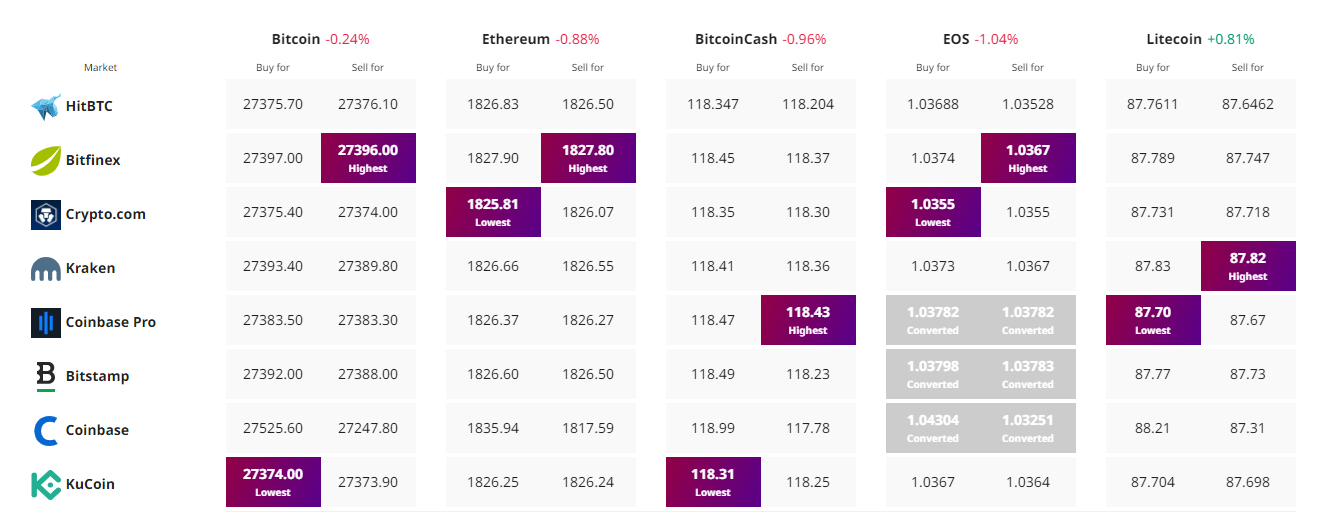

Find The Best Price to Buy/Sell Cryptocurrency