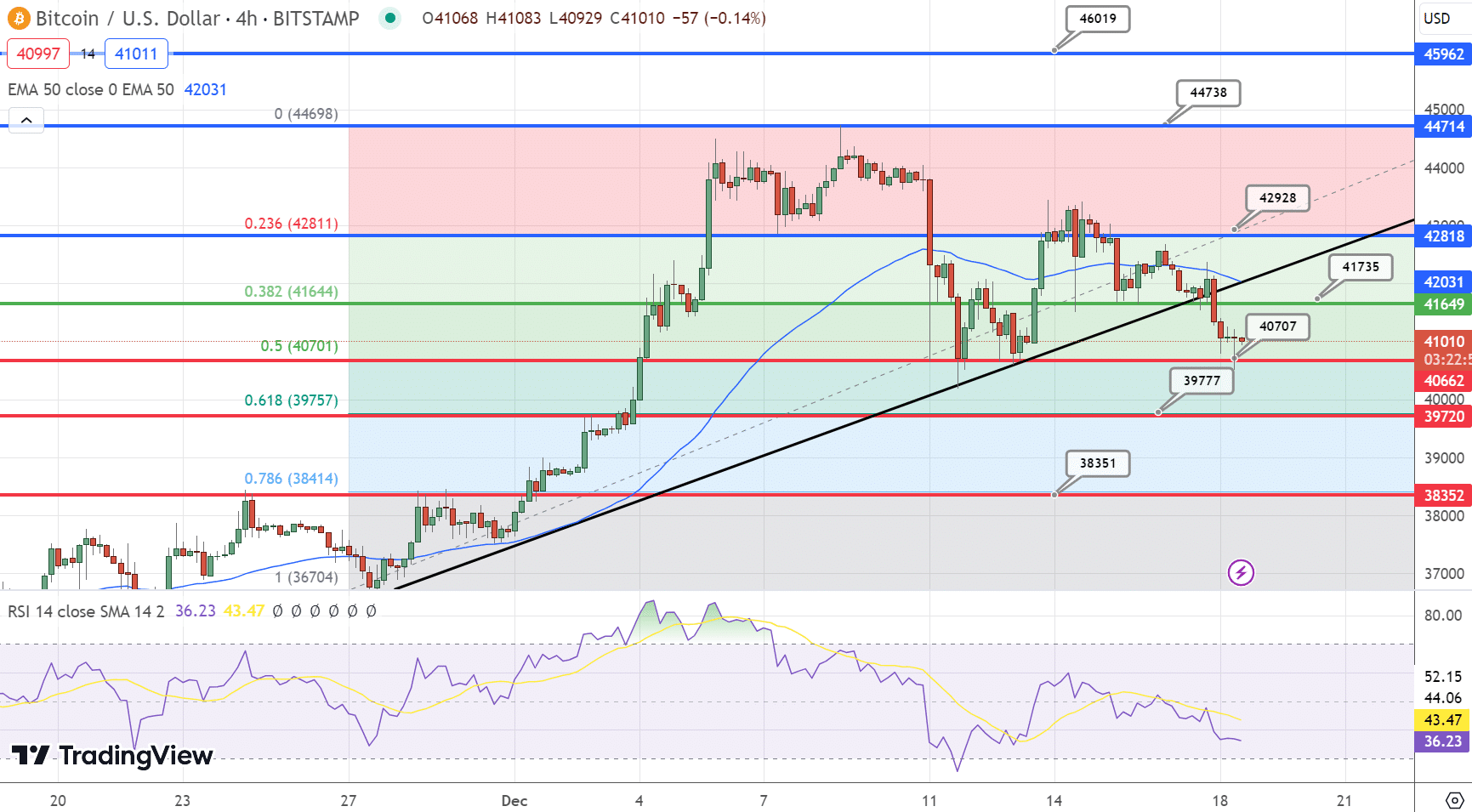

Bitcoin Price Prediction as VanEck’s CEO Says BTC Will Hit All-Time High Within 12 Months – Time to Buy?

Bitcoin (BTC), the world’s most valuable cryptocurrency, experienced a downturn over the weekend, falling to the $41,000 range. This decline is part of a broader trend that saw the global crypto market cap drop by over 8% in 24 hours, standing at $1.46 trillion. The market’s sluggishness is partly due to a lack of fresh news on ETF applications.

Despite this, there’s an air of optimism, with expectations of a potential rally as the January ETF application window approaches. This sentiment is further buoyed by bullish predictions from VanEck’s CEO and Pantera Capital, suggesting a bright future for Bitcoin’s price.

$BTC failed the retest of 42.5k

Now failling 42k

41k more likely from here #Bitcoin pic.twitter.com/x2hpsqqwfb— SAGE TRADING GUILD (@SGTGUILD) December 17, 2023

Additionally, record-breaking earnings by Bitcoin miners and increased transaction fees indicate a positive market momentum, though recent fund outflows and shifting market sentiment have contributed to the price decline.

VanEck CEO & Pantera Capital’s Bullish Bitcoin Forecasts

Jan van Eck, CEO of investment firm VanEck, has a bullish outlook on Bitcoin, predicting it will reach new all-time highs within the next year. He views Bitcoin as akin to gold, a valuable asset appealing to investors, particularly in the current economic climate. Despite political uncertainties, van Eck’s optimism is fueled by Bitcoin’s resilience and an anticipated halving event in April.

#BITCOIN

Bitcoin Will Reach New All-Time High in 12 Months, Says VanEck CEOhttps://t.co/kDImVN3NsR#BTC #USDT #deprem #web3 #Tirunelveli #ETH #Cryptocurency #CryptoNews #Messi𓃵 #NewYork #MUFC #internetdown #TNRains #XRP pic.twitter.com/2LF9JY1YP8— Moon Crypto Academy (@mooncryptoacady) December 18, 2023

Van Eck’s perspective on Bitcoin’s growth and increasing value ties closely to economic factors, especially the inverse relationship between interest rates and assets like Bitcoin and gold. As interest rates decline, Bitcoin’s attractiveness as an investment option intensifies.

Experts like van Eck and Dan Morehead of Pantera Capital believe that Bitcoin’s impending halving event is a key milestone. They liken Bitcoin’s evolution to a maturing entity, progressing beyond its earlier volatile phases. This analogy underpins their expectation of Bitcoin reaching new heights in the coming year. Morehead extends this positive outlook to 2025, considering Bitcoin’s historical trajectory.

Thus, these bullish predictions from prominent figures in the cryptocurrency sector may bolster investor confidence in Bitcoin. As more investors recognize its potential for sustained growth, this sentiment could translate into an upward trend in Bitcoin’s price.

Bitcoin Miners’ Record Earnings & Rising Fees Indicate Market Upswing

Bitcoin miners have recently hit a milestone, with their earnings reaching an all-time high of $9.98 million on December 16, eclipsing the previous record set on May 8, 2023. This surge in earnings is closely linked to Bitcoin’s rising price since early May.

CRYPTO BREAKING NEWS

Bitcoin Miner Revenue Just Hit A New All-Time High, Here’s What’s Driving It. Bitcoin miners have seen their revenue increase in recent times and even saw a new all-time high (ATH) on December 16. This comes after a long per… check us out @… pic.twitter.com/tnPIeMEWCs— InnovatekMobile (@Neome_com) December 18, 2023

A key revenue source for miners involves adding digital assets, known as “Bitcoin NFTs” or Ordinals, to the blockchain. The increasing popularity of trading Ordinals in November led to a spike in fees, crossing over $37.

Currently, the Bitcoin network is facing congestion with over 200,000 pending transactions, likely due to heightened network usage. This congestion, while challenging, benefits miners who had seen reduced earnings earlier in the year. With anticipation building towards the Bitcoin Halving in April 2024, miners are hopeful for continued network activity.

Thus, the record-high earnings for Bitcoin miners and the accompanying increase in transaction fees reflect a bullish trend in the market. These factors, combined with network congestion, point to a potentially positive impact on Bitcoin’s price trajectory.

Bitcoin’s Price Dip Linked to Fund Outflows & Sentiment Shift

Recent trends in cryptocurrency funds have indicated a notable shift in investor sentiment, interrupting an 11-week inflow streak in major asset managers like CoinShares, Bitwise, Grayscale, ProShares, and 21Shares. According to CoinShares, there was a net outflow of $16 million last week, predominantly from Bitcoin-based funds which saw outflows of $32.8 million.

Bitcoin’s 11-week streak of inflows to crypto funds comes to an end as $33 million flows out. Find out what this means for the market in our latest report.https://t.co/brzX2IDJwH

— CryptoPopTrip (@CryptoPopTrip) December 18, 2023

Additionally, short Bitcoin investment products experienced minor outflows of $0.3 million. Despite these outflows, trading volumes remained robust, with activities totaling $3.6 billion, well above the yearly average of $1.6 billion. This high trading volume occurred alongside a 5% decrease in Bitcoin’s price, ending its eight-week streak of continuous weekly gains. Bitcoin’s current trading price stands at $40,925.

The combination of a significant $32.8 million outflow from Bitcoin-focused funds and the notable price drop indicates a changing tide in investor attitudes. Although trading remains active, these recent developments have influenced Bitcoin’s market position, as evidenced by its current trading valuation.

Bitcoin Price Prediction

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.