BTC Derivatives Show Resilience Amidst Fluctuations, Eye $50K Target

Last updated: December 13, 2023 00:07 EST

. 1 min read

Despite Bitcoin (BTC) trading below its 2023 high and struggling to stay above the $41,000 mark, derivatives data suggests traders remain optimistic, eyeing a $50,000 target and beyond.

While a $127 million liquidation of leveraged long Bitcoin futures occurred on December 11, representing less than 1% of the total open interest, the impact of this liquidation on the market has dissipated.

Meanwhile, following the drop to the $40,200 area on Monday, Bitcoin’s price rebounded strongly over the next day, and as of Wednesday at press time the price remained up by 2.7% from the lows.

Futures premium still bullish

So far, Bitcoin’s recent correction has seemed less driven by derivatives markets than initially thought, with the logical conclusion then being that spot selling is at least partly to blame.

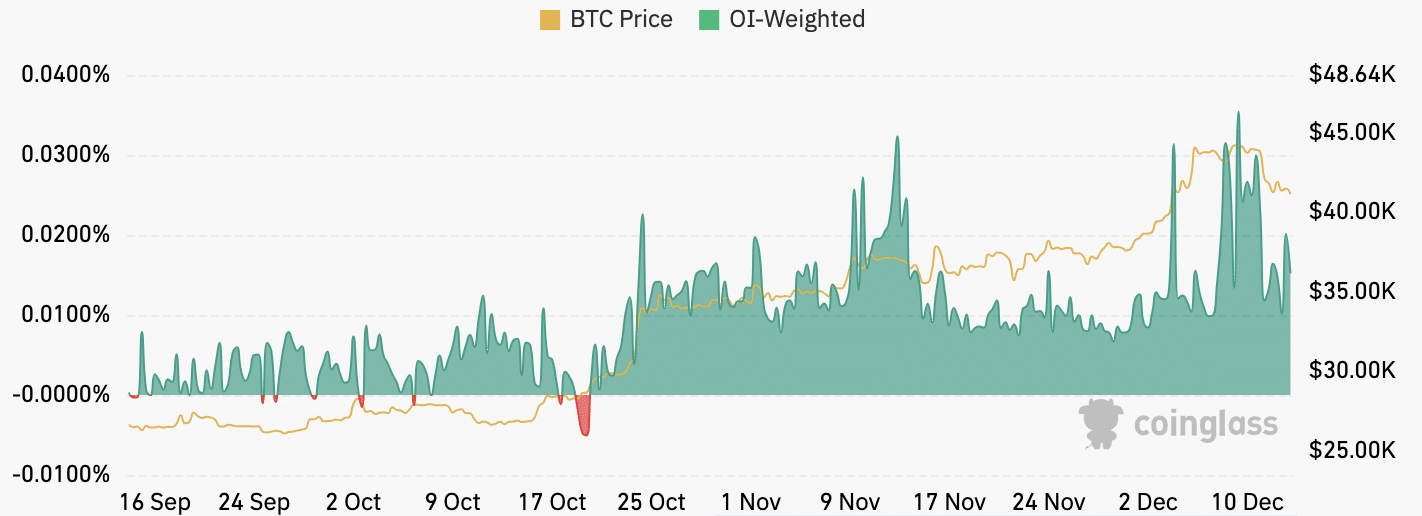

Analyzing the Bitcoin futures premium, or basis rate, reveals stability despite the price drop on December 11, with the premium remaining above the 10%.

A 10% futures premium is often seen as a threshold between neutral and bullish sentiment in the market.

Examining the BTC options market, specifically the 25% delta skew, further supports the notion of resilience. Despite the 6.1% correction since Dec. 10, the options skew has maintained a neutral stance, suggesting a balance between bullish call options and bearish put options.

Rise in futures funding rate

In addition, retail traders using leverage seem to have a healthy influence on BTC’s price action.

The positive funding rate for perpetual contracts, a sign of increased demand for leverage among long positions, experienced a modest increase from Dec. 8 to Dec. 10, the data showed.

This rise indicates that long positions in Bitcoin futures and perpetual contracts didn’t drive the recent rally or subsequent liquidations, and that the spot markets may have been more prominent.

In sum, the derivatives data remains positive, and indicates that the bullish momentum around Bitcoin is intact, with bulls now eyeing $50,000 as the next major price milestone.