NFT Trading Volume Surges 125%, Nears $1B in November: DappRadar Report

Last updated: December 8, 2023 00:51 EST

. 2 min read

Digital collectibles or non-fungible tokens (NFTs) are currently experiencing a resurgence despite the ongoing bullish momentum in the broader crypto market.

Capturing this shift, DappRadar’s November industry report revealed that the NFT ecosystem has sustained a positive trend for the second consecutive month.

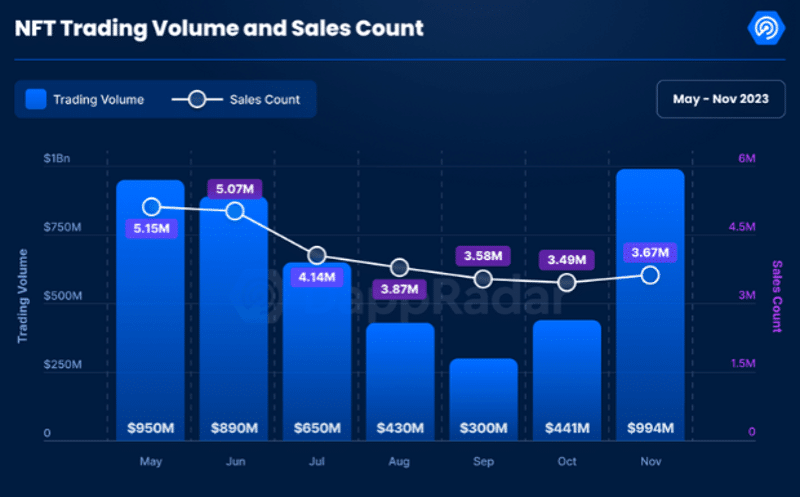

According to the decentralized application (dApp) monitoring platform, the digital collectible ecosystem witnessed an impressive 125% surge in trading volume in November.

This remarkable rally has seen it gross nearly $1 billion in trading volume within the stated month.

🖼️ Cumulative NFT trading volume rises to the highest level since May 2023 (nearly $1 billion) — DappRadar pic.twitter.com/GeUvvg0q0X

— ❇️𝙊𝙡𝙞’ 信福爱 (@olgerd_butko) December 8, 2023

However, this is not the only impressive data captured from the digital collectible ecosystem.

DappRadar also reported a modest 5% increase in sales, contributing to a total transaction output of 3.6 million in November.

This indicates that NFT investors are increasingly active in buying and selling their favorite pixelated blockchain-based assets at premium values.

The average transaction value has notably risen from $126 in October to $270 in November, representing a 114% increase within a 30-day period.

Additionally, Unique Asset Wallets (UAWs) have seen substantial growth, particularly in on-chain gaming, which reached 3.4 million UAWs, reflecting a 14% increase while holding a 34% industry dominance.

Furthermore, DappRadar highlights the significant turnaround in the fortunes of the decentralized economy in the last three months.

Following a broader interest in offering exchange-traded fund (ETF) services for the two most popular cryptocurrencies (Bitcoin and Ethereum) by several legacy-backed asset management firms, the crypto market has experienced a resurgence.

Bitcoin, the chief catalyst in the market’s uptrend, has broken through its $30,000 shackles and now sits comfortably above the $40,000 price peg in less than a month while recording over 150% increase year-to-date (YTD).

This remarkable rally has seen the crypto market climb to $1.6 trillion in its market cap within the stated period. Nonetheless, the NFT sector has also demonstrated notable progress in recent months.

NFT volume for the past 5 weeks has been steadily increasing 📈

The bottom was the week closing 9th Oct, where NFT weekly volume was 29,704 ETH, compared to last week, week ending Nov 6th, NFT sales volume reached 68,342 ETH

Slowly then suddenly…?https://t.co/SOlhKZezmO pic.twitter.com/420fiRYw9e

— Nansen 🧭 (@nansen_ai) November 6, 2023

According to a Nansen report, NFT sales weekly increased from 29,704 ETH (approximately $56 million) to 68,342 ETH (equivalent to $129 million) in a five-week span ending October 9.

NFT volume over the past 5 weeks:

W/C Oct 9th: 29.7k ETH

W/C Oct 16th: 36k ETH

W/C Oct 23rd: 47.3k ETH

W/C Oct 30th: 56.7k ETH

W/C Nov 5th: 68.6k ETH@blur_io accounted for 171,926 ETH of this volume compared to Opensea which was 37,765 ETHWhat will next week bring?

— Nansen 🧭 (@nansen_ai) November 6, 2023

The Blur NFT marketplace accounted for 171,926 ETH, surpassing OpenSea’s 37,765 ETH during the same period.

Blur Leads NFT Sector Again

The NFT ecosystem relies heavily on on-chain marketplaces, which provide an avenue for NFT buyers and sellers to transact smoothly.

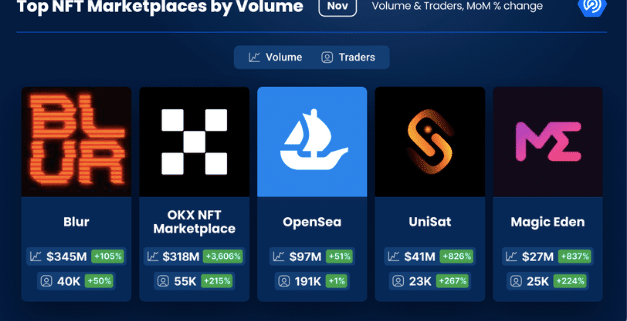

The NFT marketplace ecosystem was previously dominated by the OpenSea platform. However, DappRadar’s report continues to pinpoint that OpenSea’s competitor, Blur, is still giving it a run for its money.

According to the dApp platform, the Blur NFT marketplace leads the NFT sector with a 35% market share in trading volume.

Centralized crypto trading platform OKX comes a close second with 32%, while OpenSea comes with a third platform runner-up with a yearly low of 14% of trades executed on its platform.

However, it still has an active community of 191,000 NFT traders. This report shows that OpenSea is becoming fazed out by new entrants like the Blur NFT platform.