Bitcoin Price Pumps to $39,000 As Fed Chair Powell’s Remarks Encourage Rate Cut Bets – Where is BTC Headed Next?

Last updated: December 1, 2023 00:52 EST

. 2 min read

Fed Chair Jerome Powell’s tone on the risks faced by the US economy just shifted in a dovish direction, spurring a pump in the price of Bitcoin (BTC) to new yearly highs at $39,000.

Powell noted that risks that the Fed doesn’t raise interest rates enough to combat inflation versus the risk that it over-tightens and unnecessarily weakens the economy have become more balanced.

His comments come after recent economic data has shown the US economy cooling and with a key metric of US inflation (the Core PCE Price Index) averaging 2.5% annualized over the past six months.

Previously, Powell had been amongst the Fed policymakers warning that further interest rate hikes remained likely, and his shift in tone comes after his normally hawkish Fed policymaker colleague Christopher Waller said earlier in the week that the argument for rate cuts in 2024 was building.

Powell’s remarks sent US stock prices higher and bond yields tumbling as investors ramped up bets on rate cuts to begin in Q1 2024.

As per the CME’s Fed Watch Tool, the money market implied likelihood of the Fed cutting interest rates back to 5.00-5.25% from 5.25-5.5% by March rose to over 60% on Friday from under 45% on Thursday.

Bitcoin, still viewed by many as a risk sensitive asset, has typically in recent years had a positive correlation to US stock prices.

Meanwhile, Bitcoin has also benefitted in an environment of easing financial conditions, characterized by falling bond yields and rising liquidity.

A rate cutting cycle would be expected to trigger a substantial easing of financial conditions that could be a major bullish driver for the Bitcoin price.

Where is Bitcoin (BTC) Headed Next?

As rate cut expectations rise and, with it, expectations for a more Bitcoin-favorable liquidity backdrop, macro is a major tailwind for BTC right now.

But BTC continues to also benefit from crypto specific bullish narratives, such as an expected acceleration of institutional adoption and new buying pressure in the wake of spot Bitcoin ETF approvals in the US, which are expected to get the green light by early 2024.

A sharp rise in the assets under management of Proshares’ Bitcoin Strategy ETF, a Bitcoin futures-based ETF, to new all-time highs shows that institutions are already scrambling to gain bullish exposure to the world’s oldest and largest cryptocurrency by market capitalization.

Institution-driven elevated buying pressure in 2024 is expected to be coupled by a sharp drop in Bitcoin’s structural sell pressure from network validators (or “miners”), with the Bitcoin issuance rate set to fall in half next April.

Bitcoin miners need to constantly sell a portion of the Bitcoin they mine in order to pay for their operations.

This cocktail of bullish themes is likely to mean that Bitcoin remains a buy on the dips, as has consistently been the case in recent weeks.

After pumping 28.5% in October, Bitcoin was supported by an uptrend and its 21DMA throughout November.

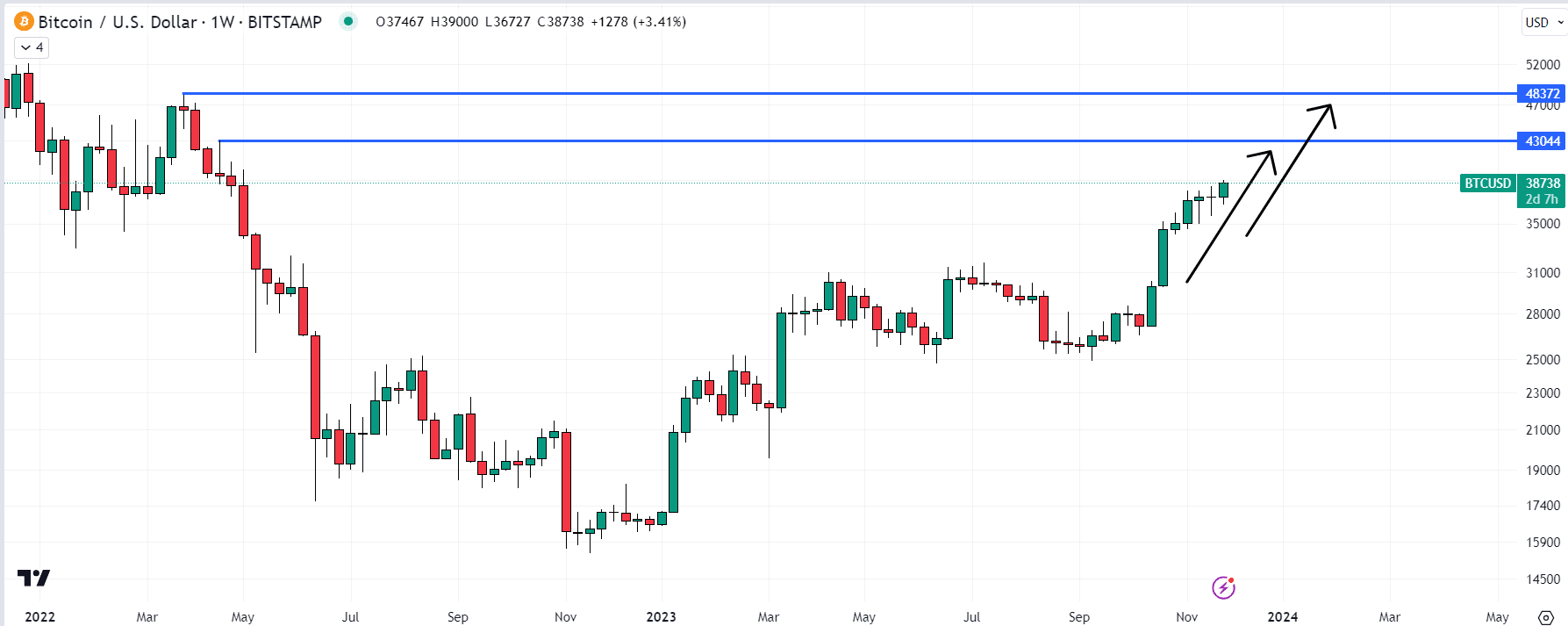

With the cryptocurrency having new seemingly broken convincingly to the north of the prior resistance at $38,000, short-term bullish speculators will be eyeing an near-term move above $40,000 and on towards resistance in the form of the April 2022 highs just above $43,000.

Some might even be targeting a test of the 2022 highs at $48,000 before the end of the year.