Bitcoin Price Prediction as Standard Chartered Reiterates $120,000 Price Target for BTC in 2024 – Time to Buy?

Last updated: November 26, 2023 20:54 EST

. 4 min read

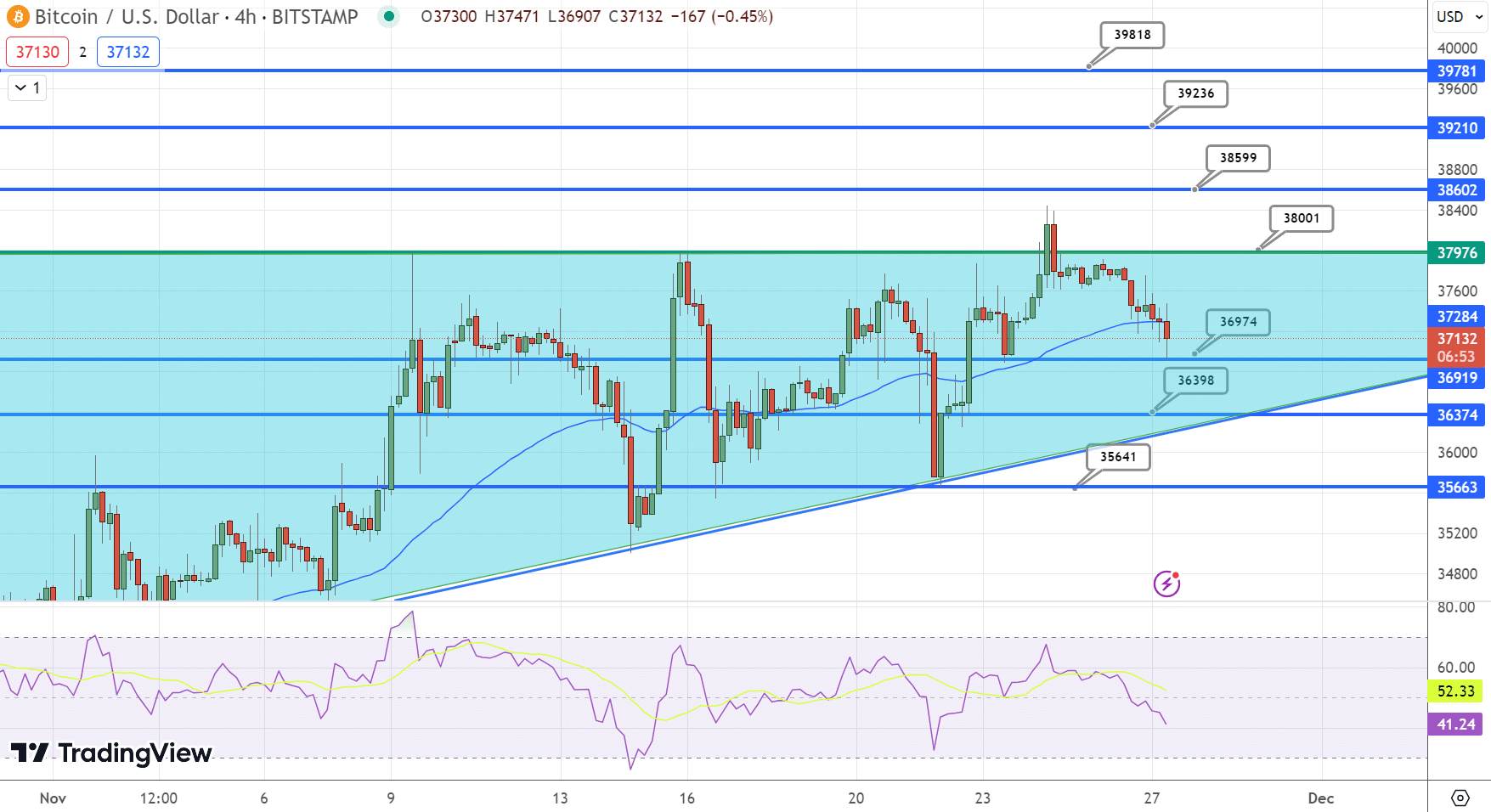

In the ever-evolving realm of cryptocurrencies, Bitcoin (BTC), the flagship digital asset, remains resilient, consistently hovering above the $37,000 threshold on Monday. The broader crypto market, with a global cap of $1.42 trillion, witnessed a modest 24-hour dip of 1.22 percent. Yet, there’s an air of optimism as the market gradually rebounds, fueled by robust investor confidence.

Notably, the crypto fear and greed index is firmly in the ‘greed’ territory, scoring 66 out of 100, hinting at positive market sentiment. For Bitcoin’s bullish trajectory to sustain, it must breach the $37,700 resistance level; failing which, it might seek support near $37,100.

1》 $BTC experienced a successful retest at $37k yesterday, holding strong and leading to the weekly candle closing in the green. Notably, this marks the sixth consecutive week of positive momentum, a feat not observed in the past three years #bitcoin #GOLD pic.twitter.com/D2mRFNzQyY

— G0LD◁ (@G0LD161) November 27, 2023

Amidst this cautious optimism, a notable projection from Standard Chartered analyst Geoff Kendrick stands out, suggesting Bitcoin could soar to a staggering $120,000 by the end of 2024. This bullish forecast aligns with the current reduction in Bitcoin sales by miners, indicating a potential tightening of supply.

#CryptoNews #BTC #ETF #SEC

SEC has published memos officially confirming negotiations with BlackRock and Grayscale regarding the listing of spot BTC-ETFs.#BTC #crypto #opinion

Standard Chartered has confirmed its forecast for BTC at $120,000 by the end of 2024. It expects BTC… pic.twitter.com/sMFWibsof8— FinNews (@FinNews_) November 26, 2023

Adding to the positive outlook, anticipations of a more accommodating stance from the US Federal Reserve in the upcoming year are also buoying Bitcoin’s prospects. Such a policy shift could bolster investor confidence further in the cryptocurrency. Concurrently, the weakening sentiment around the US Dollar has been a significant factor bolstering Bitcoin’s price, painting a complex yet promising picture for the world’s leading cryptocurrency.

Bitcoin’s Upswing: Mining Profits, Wall Street Buzz, and Bullish Forecasts

Bitcoin is poised for a significant upswing, potentially reaching $120,000 by the end of 2024. Geoff Kendrick, an analyst at Standard Chartered, attributes this potential rise to a reduction in Bitcoin sales by miners, fostering a more favorable market environment. Initially projecting Bitcoin to hit $100,000 next year, Kendrick has revised his estimate to $120,000, suggesting an almost 300% increase from current levels. He predicts a 67% increase in Bitcoin’s value this year, targeting $50,000.

Bitcoin could surge 300% to $120,000 next year as miners reduce token sales, Standard Chartered says https://t.co/pBsslajq3p

— Joe Martin (@JoeMartinBTC) November 26, 2023

Increased mining profitability underpins this optimistic forecast. Higher profits enable miners to sell fewer bitcoins, maintaining their cash flow and consequently reducing Bitcoin’s overall supply. Kendrick estimates that with Bitcoin averaging $50,000 by early 2024, miners would need to sell only 27% of mined bitcoins to generate the same cash flow as selling 100% in Q2-2023. This scenario could diminish Bitcoin’s net supply by approximately 250,000, influencing its price and reducing its inflation rate.

Bitcoin’s recent rebound above $30,000 has been bolstered by positive developments like Wall Street’s growing interest in Bitcoin ETFs. Analysts, including Tom Lee of Fundstrat, have predicted Bitcoin could reach as high as $200,000 in the coming years. Factors like the increasing profitability of mining, cost reductions by large-scale miners, and forthcoming halving events also support this optimistic trend.

Consequently, Wall Street’s interest in ETFs and bullish forecasts by analysts are key drivers behind Bitcoin’s recent price resurgence and its potential for future growth.

US Dollar Weakness and Mixed PMIs: Influencing BTC and Market Mood

The recent softness in the US Dollar has been a boon for Bitcoin, further influencing the broader market sentiment. This weakness in the dollar primarily stems from the mixed signals sent by the S&P Global Purchasing Managers’ Index (PMI) data, leading to speculation that the US Federal Reserve may adopt a more relaxed monetary policy by 2024.

The latest release for November indicates a stable US S&P Global Composite PMI at 50.7. However, while the Services PMI saw a minor uptick to 50.8, the Manufacturing PMI dipped to 49.4, not quite reaching the forecasted 49.8.

Traders expect @federalreserve to cut rates by 100 basis points next year, weakening the dollar. A weaker greenback often bodes well for $BTC. reports @godbole17.https://t.co/5hMa2QGAAt

— CoinDesk (@CoinDesk) November 27, 2023

This mixed economic picture is reflected in the US Dollar Index, which is struggling around 103.40, despite a slight improvement in US Treasury yields, which stand at 4.50% for 10-year and 4.97% for 2-year bonds. The weakening dollar, influenced by these mixed PMI outcomes and the anticipated shift in the Fed’s policy, is indirectly bolstering Bitcoin’s appeal.

Bitcoin Price Prediction

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.