Is Illuvium Going to Zero? ILV Price Suffers 6.2% Fall as Strange Mining Token Steals the Limelight

Last updated: November 24, 2023 07:12 EST

. 6 min read

Rising GameFi project Illuvium, the decentralized studio building the world’s first interoperable blockchain gaming universe, has seen a -6.2% retracement move for ILV price, and some worried bag-holders are now asking ‘is Illuvium going to zero?’.

This comes following something of a recovery as of late, after a disappointing -97% performance since 2021 for what was one of the most anticipated crypto game releases in history.

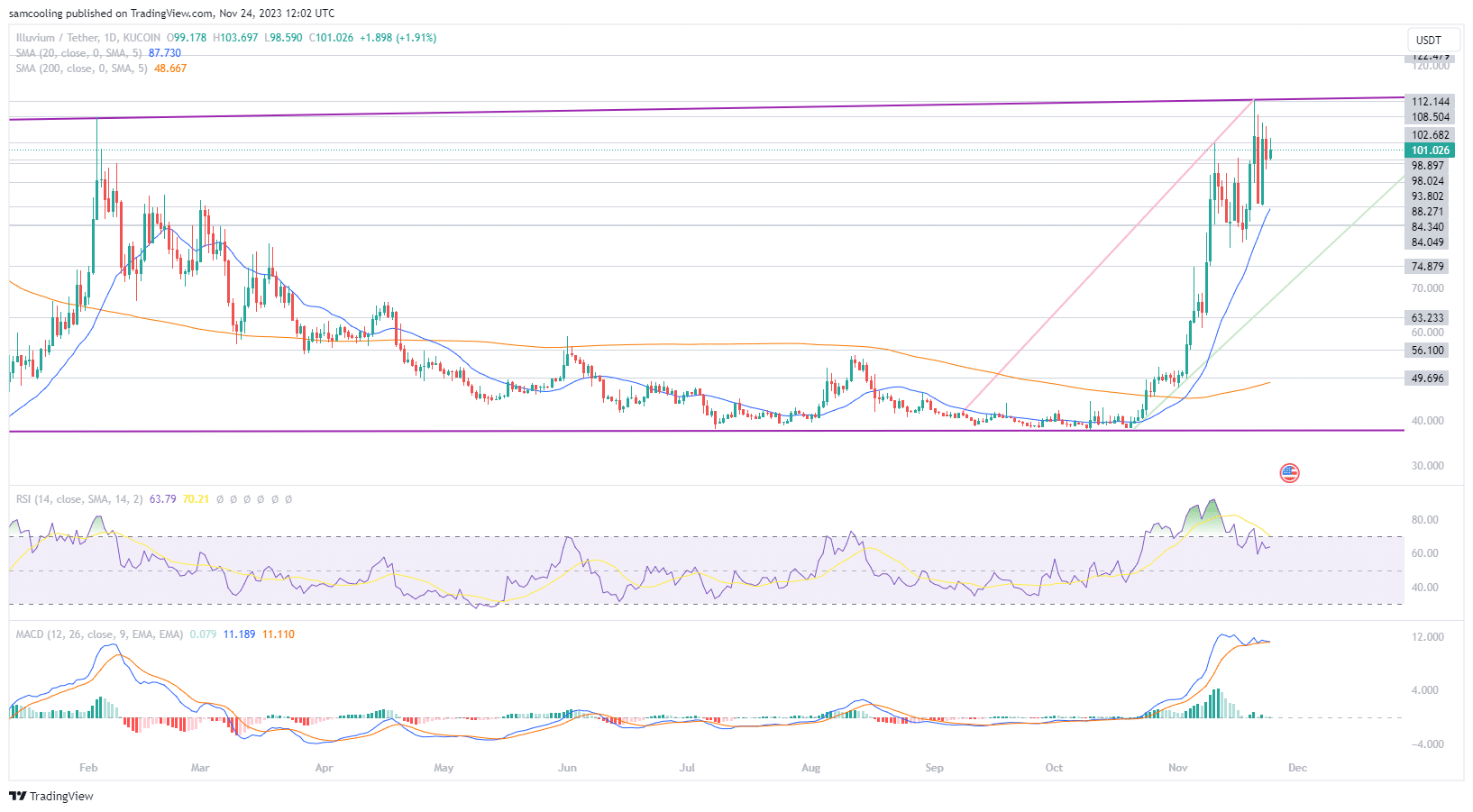

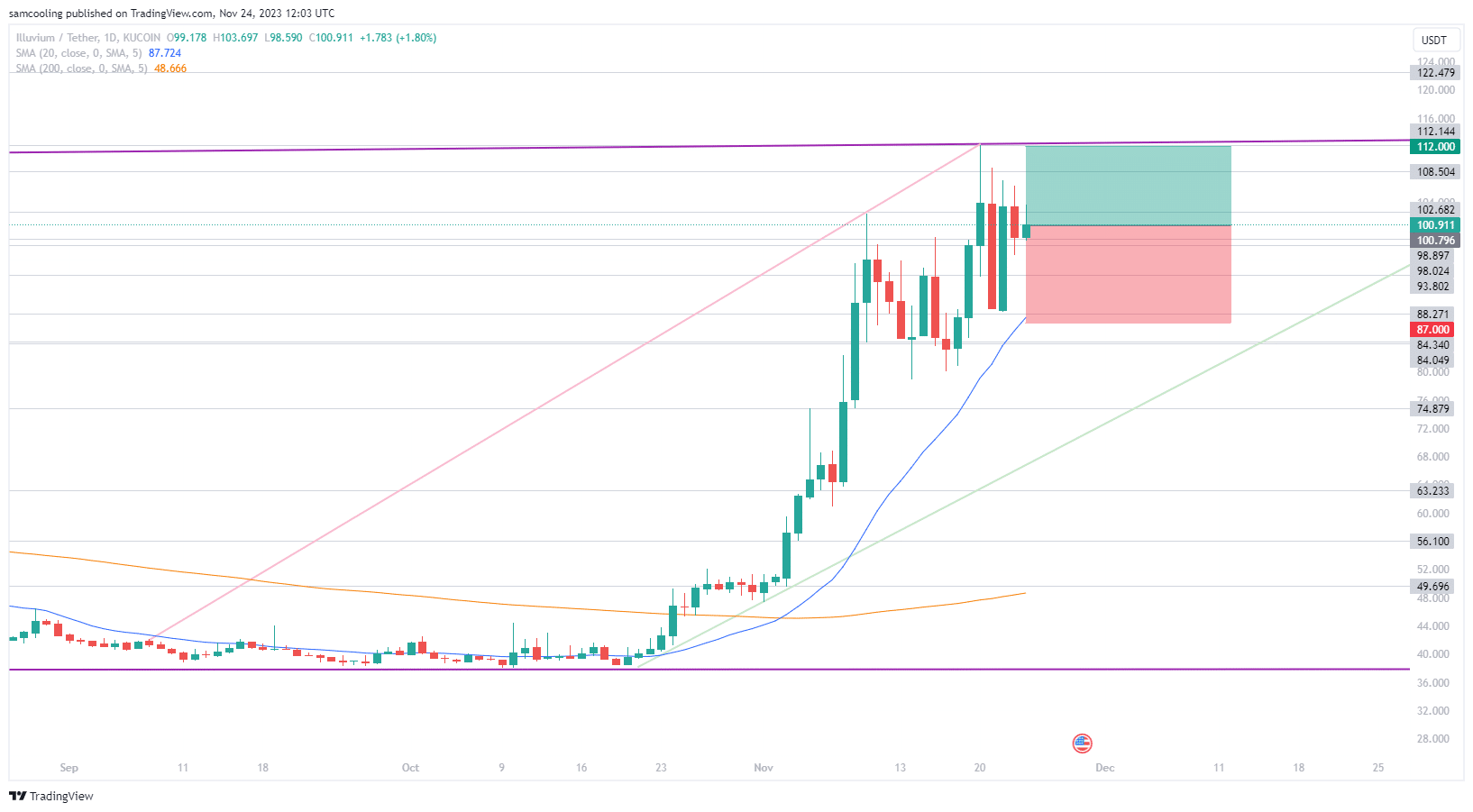

Yet, retracement move has been triggered by a multi-month trading channel, which has formed a capstone of resistance for any significant move above $110 since August.

#ILLUVIUM $ILV is currently facing a MULTI-MONTH RESISTANCE!

Watch out! pic.twitter.com/lSbvzqCKXz

— CryptoBusy (@CryptoBusy) November 23, 2023

Market sentiment is ring alarm bells, as prominent traders warn of a serious risk of retracement here – lets take a closer look.

ILV Price Analysis: Is Illuvium Going to Zero After Trading Channel Triggers Retracement Move?

AS ILV price reels following rejection from upper trendline resistance, Illuvium is currently trading at a market price of $101 (representing a 24-hour change of 2.83%).

This comes after the ILV price rally, which has gained +194% over the past month, hit a localized top of $112 – sending price tumbling into retracement.

However, so far the drop has been well-defended by ILV bulls, with a local support level established in a zone between $84 and $100 over the weeks preceding the test of upper trendline resistance.

Yet, the shift into the upper trading channel comes at a time of immense strength in ILV price, following a golden cross between moving averages in early November, which has since seen the ascendant 20DMA (sat at $87) providing footing to the impressive price growth.

It seems likely that given the well defended bullish pendant structure, ILV price will continue to consolidate at these levels, awaiting a rise in the 20DMA to attempt a second re-test of the upper trendline.

In a further sign of encouragement, the RSI has cooled-down substantially amid the drop in ILV price, now reading only minor bearish divergence at 63.

This suggests there could soon be the capacity for upside movements to resume, and this sentiment is backed by the MACD, which shows continued bullish divergence at 0.079.

Overall, ILV price looks incredibly healthy here, with a well-defended retracement move, leading to consolidation ahead of a second retest of the ongoing resistance level.

This leaves ILV price with an upside target at resistance around $112 (a potential +11.12%).

While downside risk could see ILV price fall back down to the 20DMA at $87 (a possible -13.7%).

Illuvium therefore carries a current risk: reward ratio of 0.81 – a bad entry – worthy of patience while the 20DMA catches up, but certainly not going to zero just yet.

But as ILV price awaits consolidation, traders are shifting their attention to a moon-shot Bitcoin cloud mining play that could make it big over the next year.

ILV Price Retracement Alternative? Don’t Miss Bitcoin Minetrix Presale As Almost $4.4M Raised

Dive into the innovative world of Bitcoin Minetrix and its pioneering stake-to-mine system – as the skyrocketing presale smashes +$4,315,941 raised.

Offering an enticing 141% Staking APY, Bitcoin Minetrix provides a platform where users can buy, stake, and then watch as the rewards start accumulating.

The true essence of passive income in the crypto world has never been this accessible.

With the Bitcoin Minetrix approach, gone are the days of heavy initial capital and navigating complex mining contracts.

Just 3 days remaining till the end of #BitcoinMinetrix Stage 9!

pic.twitter.com/wj9yA0xRgp

— Bitcoinminetrix (@bitcoinminetrix) November 24, 2023

Bitcoin Minetrix Smashes $4.4M Raised as Traders Rally Against Bitcoin Mining Centralization

Since the 2021 Bull Run, Bitcoin mining has defied expectations by undertaking something of a renaissance in network growth.

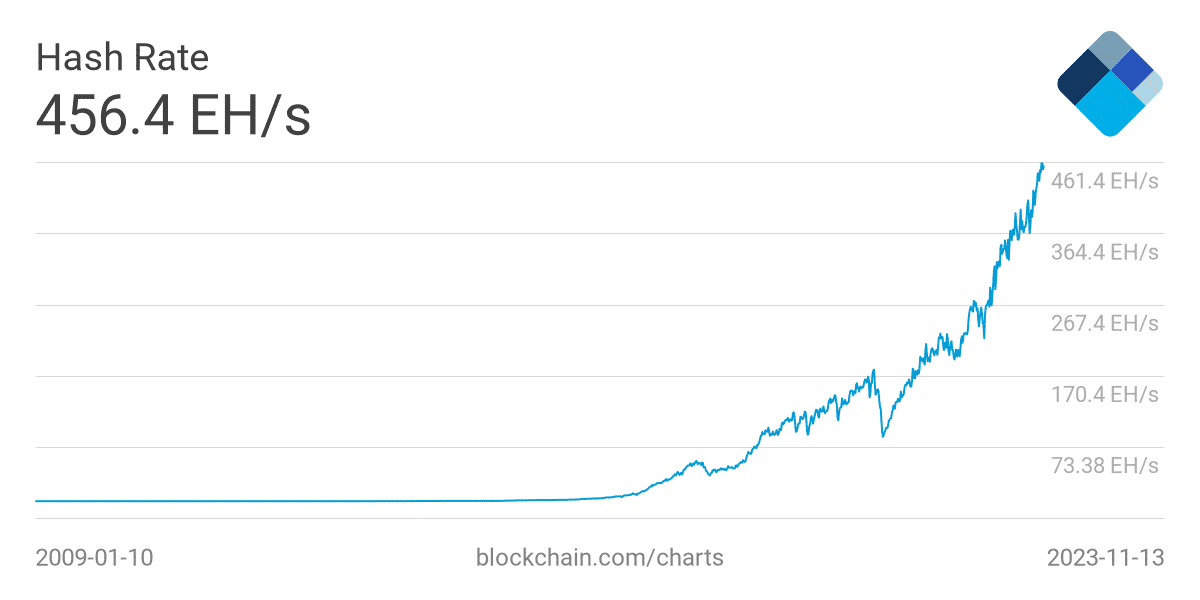

Bitcoin’s Hash Rate (a measure of the total amount of computational power directed at mining Bitcoin blocks) has surged to an incredible all-time high of 456.6 Exahashes per second (EH/S).

This dramatic growth has been fuelled by a substantial increase in the scale of Marathon Digital and Riot Platforms’ mining operations.

The world’s largest Bitcoin miner – Marathon – reported that for Q3 2023 it had an average hash rate of 14.2 EH/s (a 500% growth YoY), around 4% of the overall network hash (mining around 1153 BTC per month, or, $42.2M USD).

Meanwhile Riot Platforms reported a new record hash rate of 10.9 EH/s (mining around 368 BTC per month, or, $13.3M USD), with Riot’s operations expected to grow to 20.2 EH/s by summer 2024.

But while the all-time high in Bitcoin network hash rate is healthy for Bitcoin network security, and clearly profitable for growing mining operations, it has also begun to lose sight of the original promise of Satoshi Nakamoto’s decentralization.

Bitcoin mining in 2023 is the most centralized it has ever been in its short 15-year history.

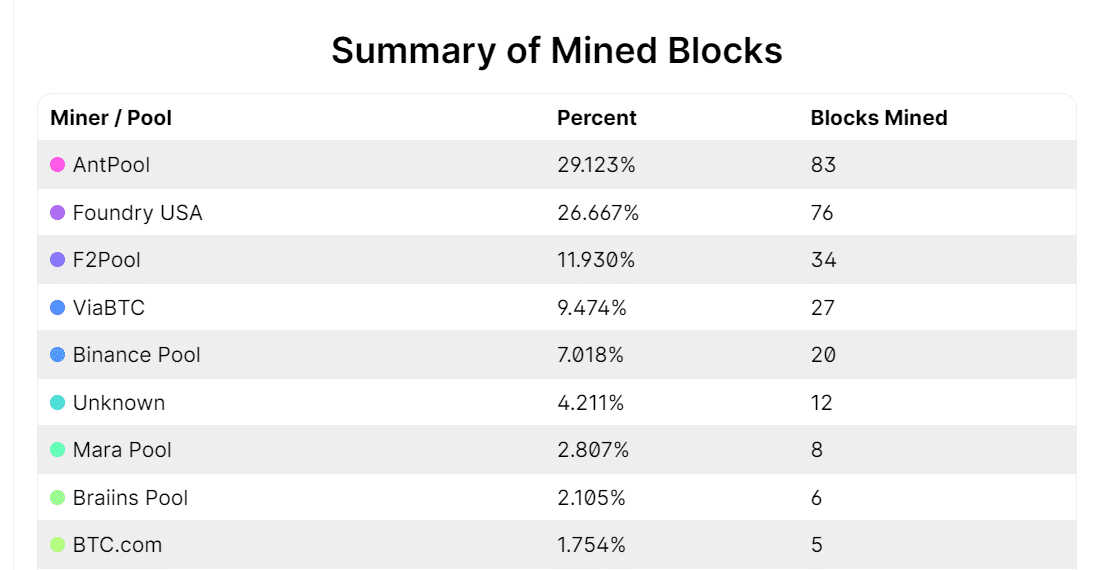

A closer look at the summary of mined blocks over the past 48-hours reveals that a shocking 55.79% of all Bitcoin block rewards go to just two Bitcoin mining pools.

AntPool took the largest share at 83 blocks mined (29.123%), while second largest mining pool Foundry USA mined 76 blocks (26.667%).

This dwarfs the number of blocks mined by even third place F2Pool (34 blocks mined, around 11.93%), highlighting the growing challenge of increased mining centralization.

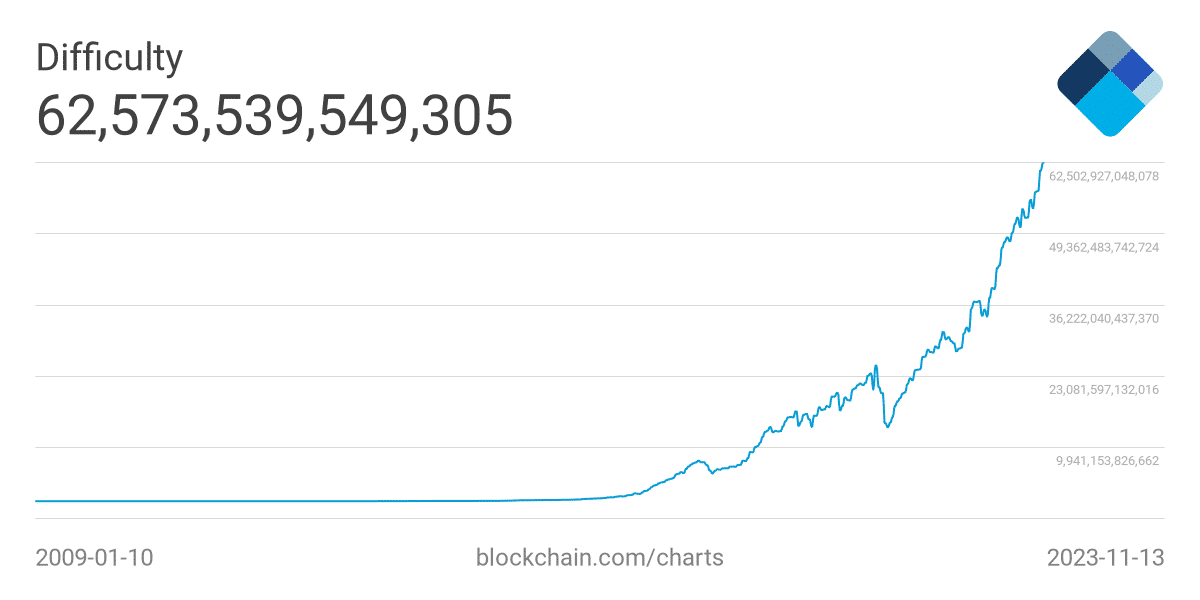

This heightened network activity, and increased centralization of mining power has become clearly reflected in the consequent all-time high in the difficulty rate for mining Bitcoin.

Currently standing at 62,573,539,549,305 – it has never been harder for the individual participant to engage in profitable Bitcoin mining.

This challenge of heightened network difficulty, fuelled by increased competition and centralization of mining power, has created the need for new solutions for the retail investor to participate in Bitcoin mining – both for network decentralization and preserving Bitcoin as a profitable activity for the individual.

Enter Bitcoin Minetrix, which was launched to deliver secure and transparent Bitcoin mining rewards for the retail investor through an innovative, decentralized Bitcoin cloud mining approach.

Key Highlights of the BTCMTX Advantage Over Celestia Price Retracement:

- Distinctive Edge in the Market: In an industry filled with numerous cloud mining platforms, Bitcoin Minetrix carves a niche for itself. As the first-ever tokenized Bitcoin cloud mining initiative, it offers an automated system that’s geared for cloud-based Bitcoin mining, setting a new standard for the industry.

- Safety First with Ethereum Blockchain: Bitcoin Minetrix operates on the tried and trusted Ethereum blockchain. This ensures top-notch security and reliability, allowing users to sidestep the risks associated with external mining pools, and offering a safeguard against potential fraudulent cloud mining services.

- Championing True Decentralization: At its core, Bitcoin Minetrix upholds the ethos of decentralization. In an age where centralization often introduces vulnerabilities, Bitcoin Minetrix breaks the mold, redistributing mining profits from big corporations to individual retail investors through its novel Stake-to-Mine system.

- Tapping into the Bitcoin Halving Opportunity: Perfectly poised to make the most of the upcoming Bitcoin halving, Bitcoin Minetrix provides investors with a golden opportunity. The impending halving might seem daunting for miners due to reduced block rewards, but historically, such events have driven up Bitcoin’s value. Bitcoin Minetrix provides a platform for investors to tap into this potential surge, sans the associated capital risks.

- The BTCMTX Presale Opportunity: The ongoing BTCMTX presale has already garnered significant interest, with over $4.35m raised towards its $4.4M goal. At a competitive price of just $0.0117 per token, early investors have a unique chance to be at the forefront of this stake-to-mine evolution.

In sum, Bitcoin Minetrix is set to redefine the Bitcoin landscape. With its innovative methodologies, stringent security measures, and the vast potential of its stake-to-mine mechanism, it beckons as a lucrative opportunity for early-bird investors.

Secure your position in this transformative journey by joining the BTCMTX presale today.

Buy BTCMTX Here

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.