Bitcoin Price Prediction as US Core Inflation Rate is Announced – Is the Bear Market Officially Over?

Bitcoin (BTC) is trading at daily lows in the $36,100s in wake of the release of the latest US inflation figures for October, despite the numbers coming in lower than expected across the board.

The headline Consumer Price Index (CPI) showed prices remaining flat in October, less than an expected rise of 0.1%, and rising at a rate of 3.2% YoY, less than the expected 3.3%.

The Core CPI, which is more closely watched by the US Federal Reserve to gauge underlying price pressures, rose just 0.2% MoM, below the expected 0.3% and in fitting with an annual core inflation rate of just over 2.0% (the Fed’s inflation target).

The latest inflation figures, which come on the heels of soft US labor market and manufacturing PMI data released earlier this month, paint a picture of a US economy that is cooling off, reducing the need for the Fed to keep on raising interest rates, which are high relative to the inflation rate at 5.25-5.5% (meaning a high “real interest rate” and tight financial conditions).

That’s the way investors seem to be viewing it anyway.

As per the CME’s Fed Watch Tool, US money markets are currently pricing a 0% chance of any further interest hikes this cycle, and a 30% chance that the Fed starts cutting interest rates as soon as March, up from a 10% chance prior to the release of the latest inflation figures.

As bets on an imminent Fed cutting cycle ramp up, the US Dollar Index (DXY) and US government bond yields are dumping, whilst US stock prices are pumping.

The DXY fell over 1% on Tuesday to new two-and-a-half-month lows at 104.50, the US 10-year yield fell nearly 20bps to hit near two-month lows under 4.50% and S&P 500 pumped 1.7% to near September’s highs around 4500.

Given Bitcoin’s historic positive correlation to the US stock market and negative correlation to the DXY and US yields, this is creating a strong macro backdrop for the cryptocurrency that should support its price.

As a result, some are confused as to why BTC is lower on Tuesday, given the strong positive moves being seen in traditional asset classes.

Bitcoin was last down just over 0.5% on Tuesday, likely due to the fact that short-term speculators are still booking profit in wake of Bitcoin’s strong performance in October/early November.

Price Prediction – Is the Bitcoin Bear Market Official Over?

With Bitcoin up roughly 120% in 2023, it’s been safe to say for a while now that the Bitcoin bear market of 2022 is over.

Aside from the brief blip in March 2020 due to the Covid-19 panic, Bitcoin has never seen such a strong and sustained bounce from bear market lows only then to give it all back.

Moreover, Bitcoin continues to follow perfectly in the footsteps of its typical roughly four-year cycle, which after a one-year pullback (as seen in 2014, 2018 and 2022) is then followed by a roughly three-year pump to new all-time highs.

With Bitcoin seemingly on the verge of getting spot ETF approvals in the US, which are expected to substantially boost demand from institutions, and macro investors increasingly betting that the US is heading towards easier financial conditions, the fundamentals certainly support the view of further medium to long-term upside.

Price predictions will remain bullish, even if Bitcoin remains at risk-off short-term profit-taking-fuelled pullbacks.

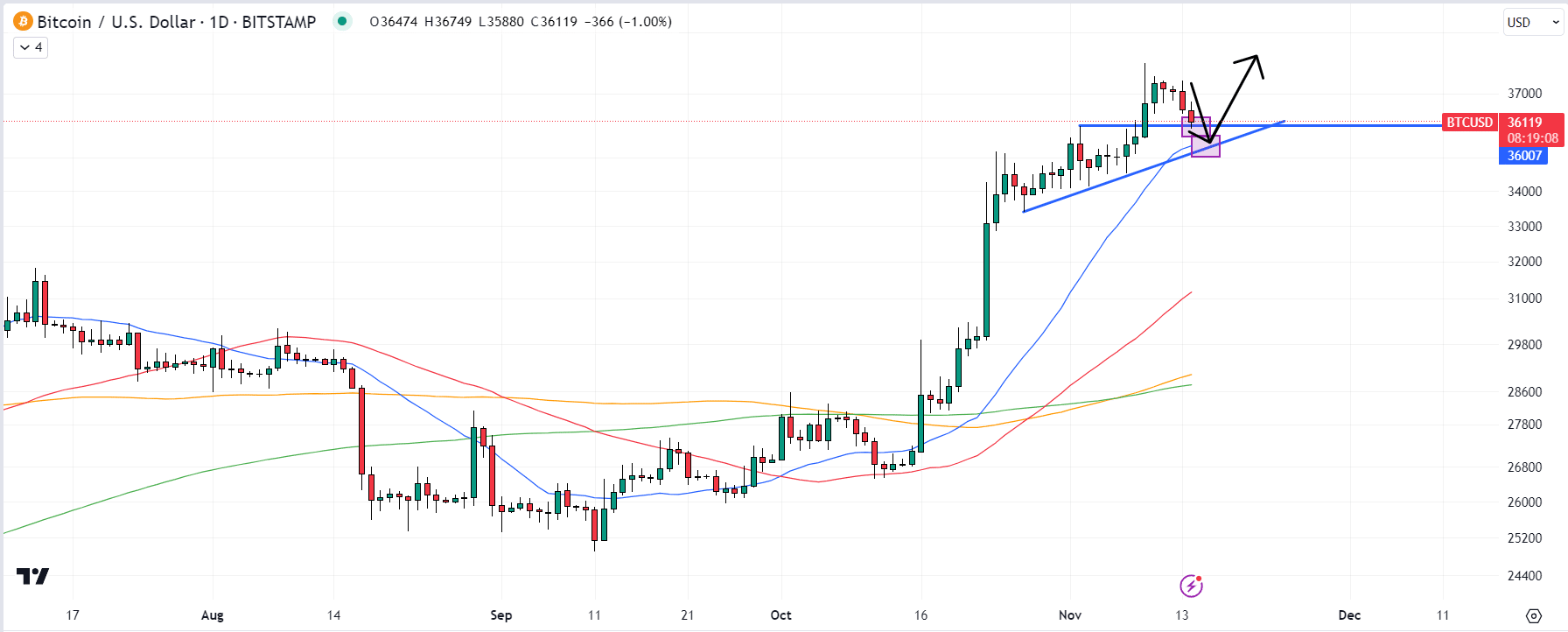

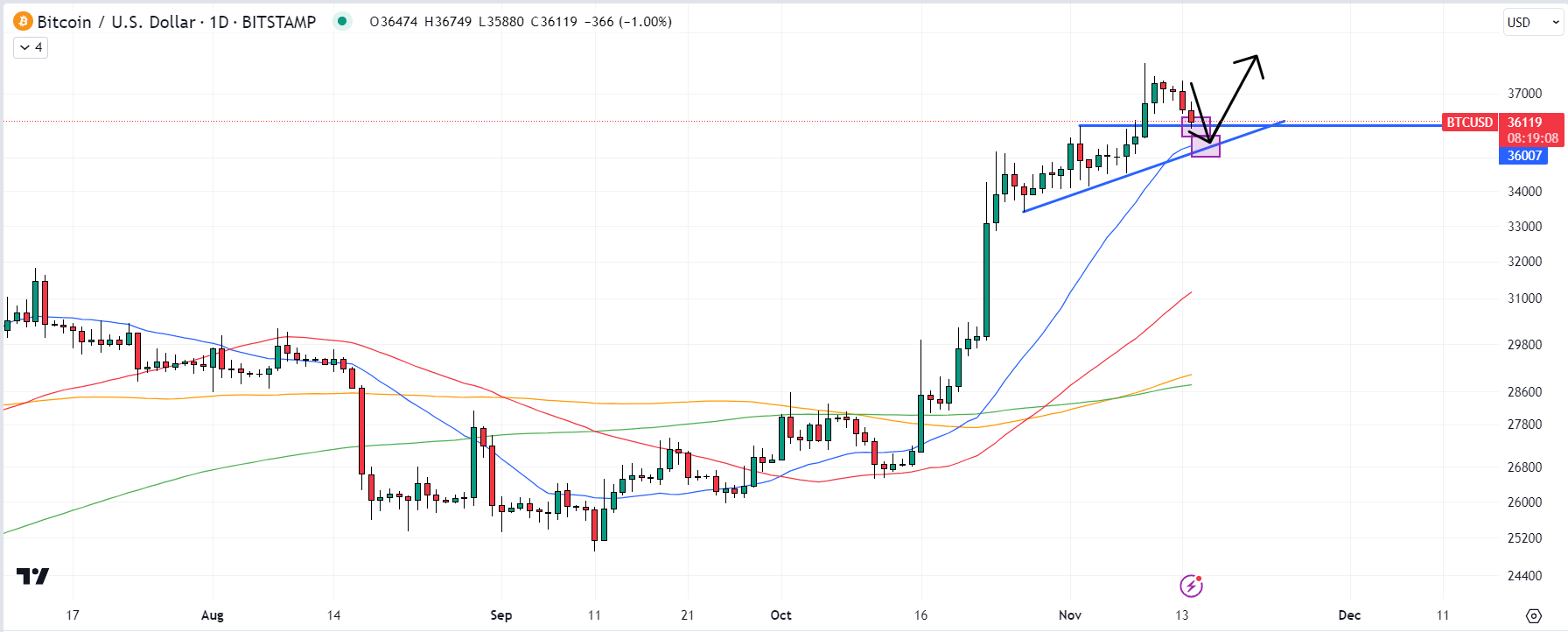

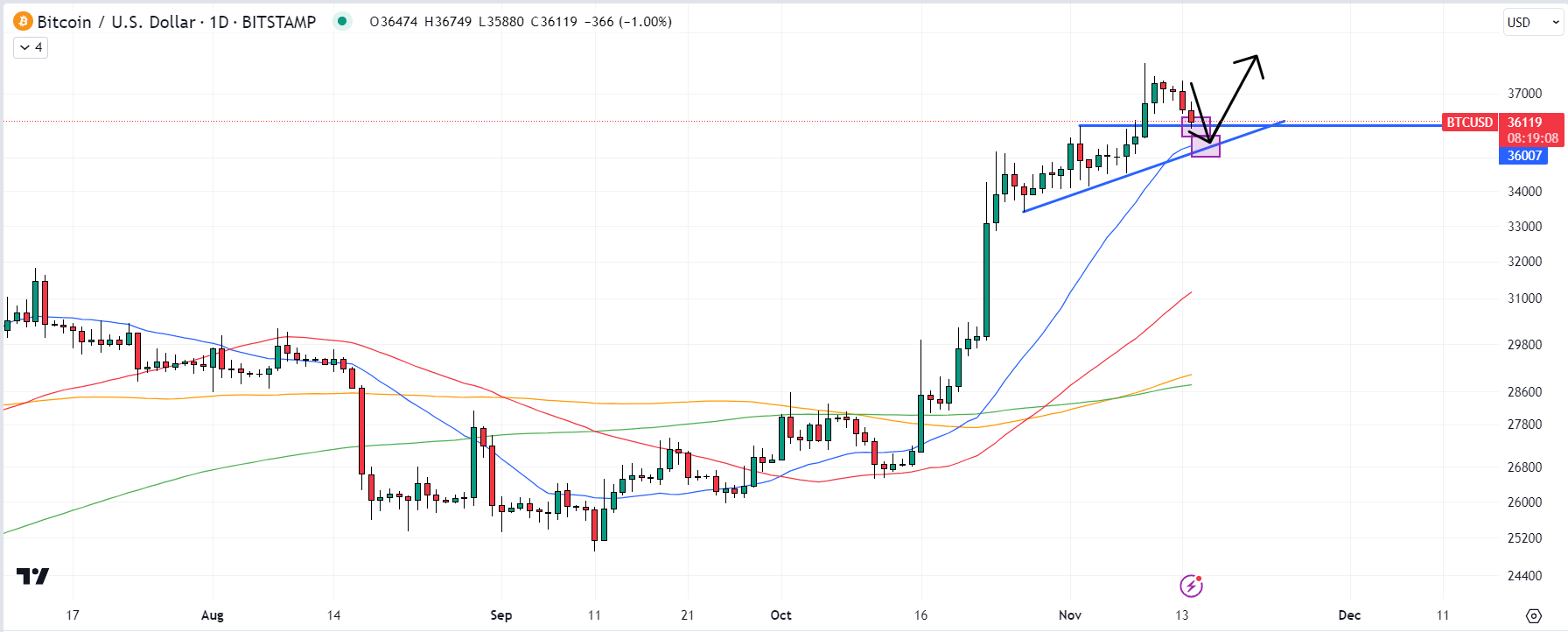

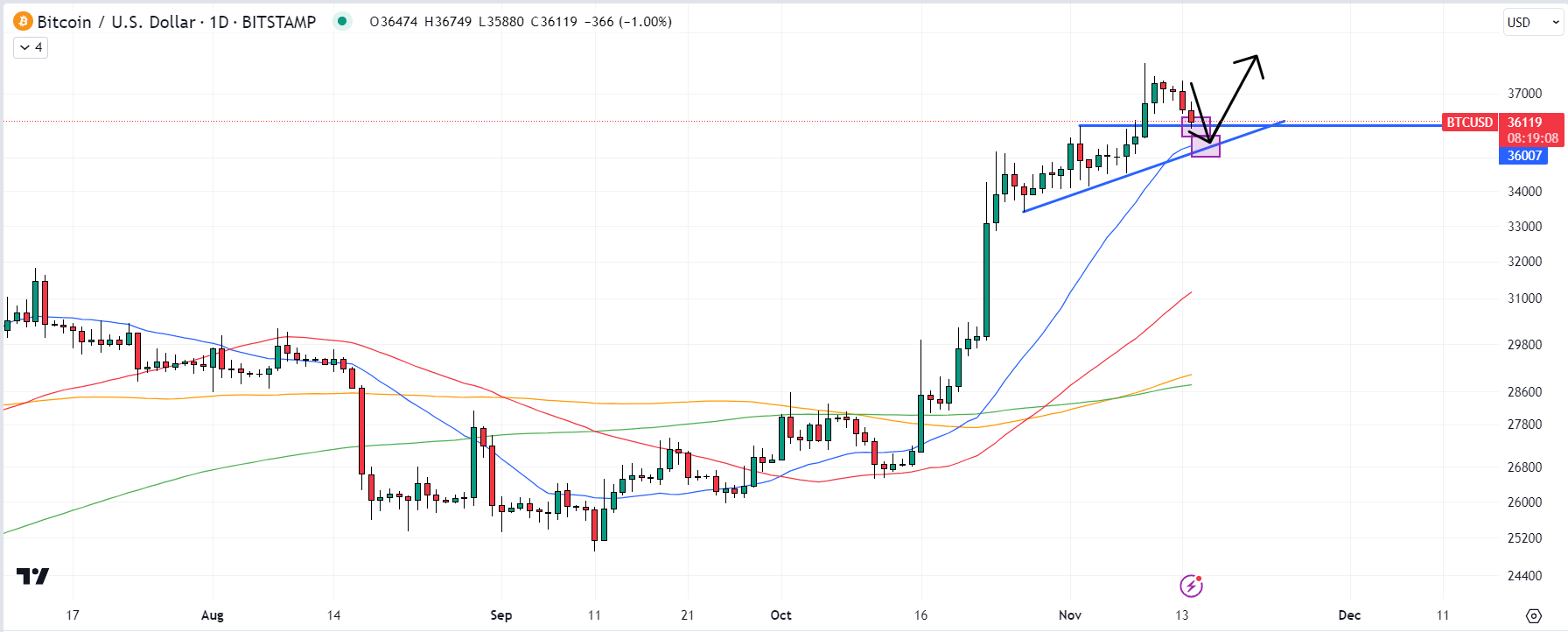

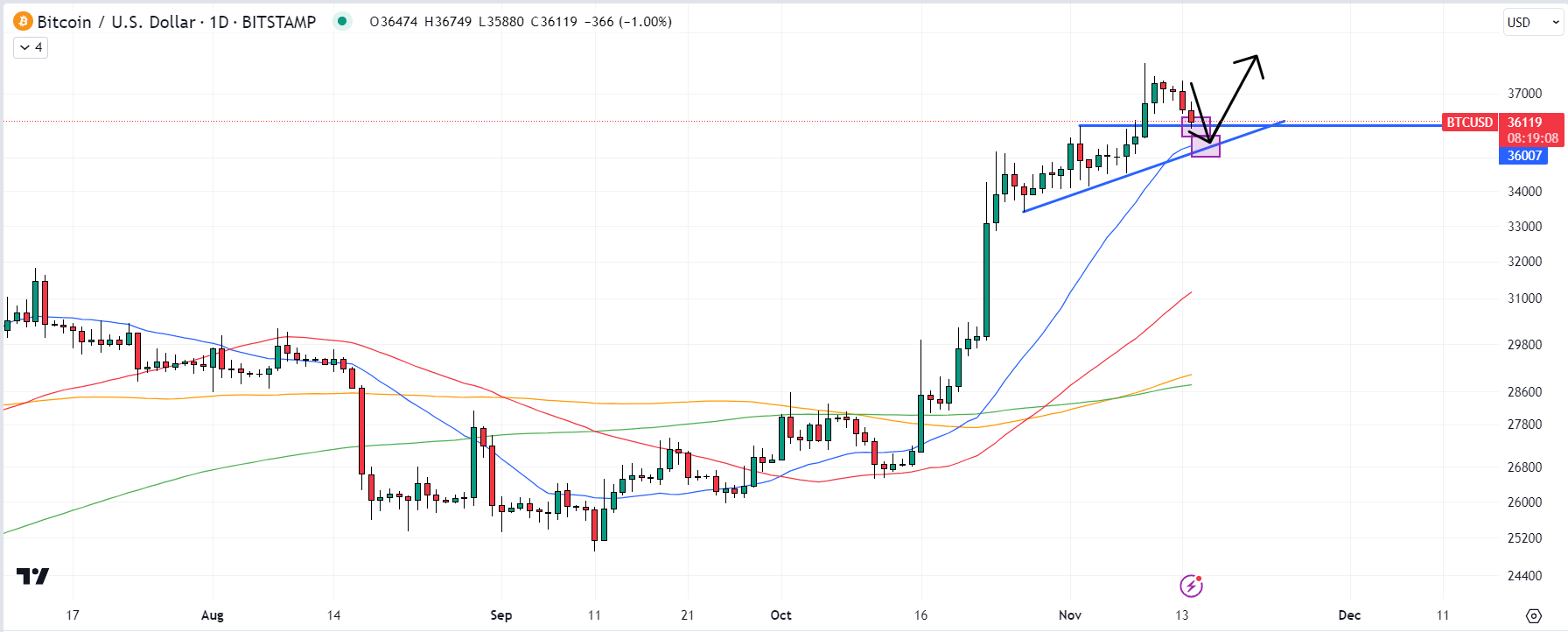

Bulls will be monitoring whether Bitcoin tests support in the form of early November highs at $36,000, or its short-term uptrend and 21DMA in the low $35,000s.

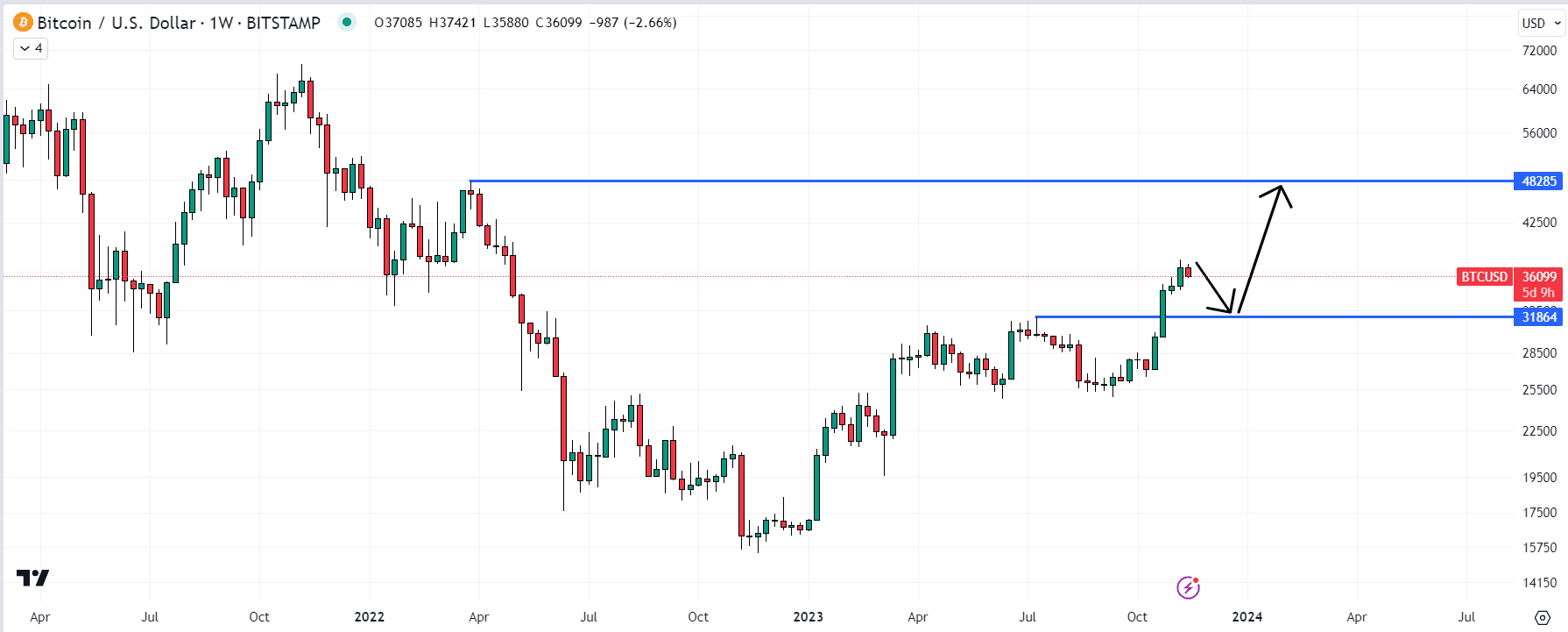

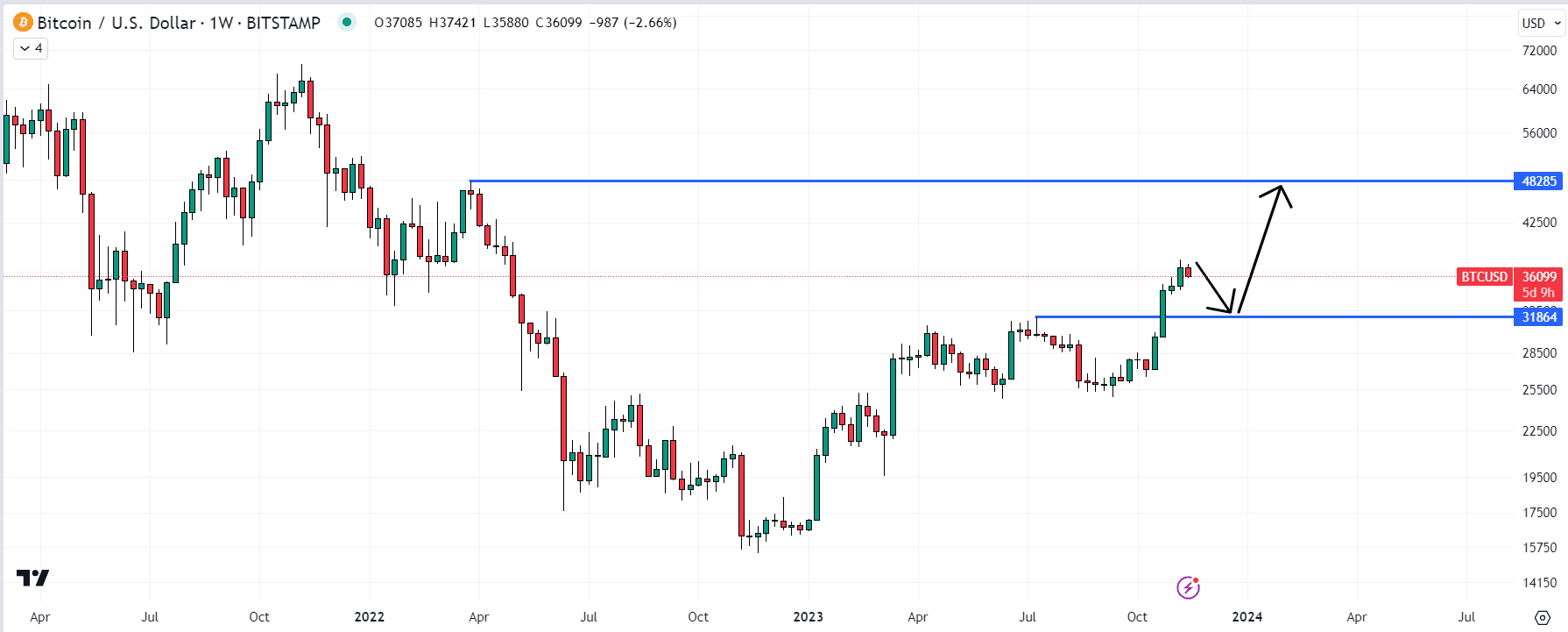

A break of these support levels could open the door to a short-term pullback to the previous 2023 highs just under $32,000.

But expect bulls to use dips as opportunities to add to long positions, with chart analysis suggesting a medium-term test of $48,000 remains a strong possibility.

Bitcoin ETF Token ($BTCETF)

Bitcoin’s medium-term outlook is strong, but the market remains at risk of short-term pullbacks.

A better alternative for those hunting for quick short-term gains might be a newly launched token called Bitcoin ETF Token, which is designed to reward token holders every time new developments occur in the Bitcoin ETF approval saga.

Despite only launching its presale a few days ago, Bitcoin ETF Token has already been able to pull in over $580,000 from investors because of its audacious pitch into the lucrative Bitcoin ETF theme that underpins the current crypto rally.

$BTCETF is also garnering attention because of its DeFi attributes.

$BTCETF tokens can be bought in presale today and staked to earn an annual percentage yield currently sitting at 487%, as per the project’s official staking dashboard.

Buy BTCETF Here