Bitcoin Price and Ethereum Prediction: DOGE Soars 35%, Will BTC and ETH Follow Suit?

The cryptocurrency market has experienced many ups and downs lately, but things are looking positive now. This trend may be attributed to the improving global economy and lower inflation rates.

Bitcoin, one of the most well-known cryptocurrencies, has gained significant traction recently, surpassing the $29,000 mark for the first time since June 2021.

This year, BTC, the world’s largest cryptocurrency, has seen an increase of approximately 70%.

Meanwhile, Ethereum, the world’s second-largest cryptocurrency, has reached $1,858 levels, its highest since August 2022. Ethereum has risen by over 9.8% this month and nearly 50% this year.

Elon Musk’s Twitter Update Sends Dogecoin Soaring

Dogecoin (DOGE) has experienced a surge in value once again, thanks to an update on Elon Musk’s Twitter profile. The tech billionaire changed his profile picture to a Shiba Inu, the breed of dog that inspired the creation of the meme-based cryptocurrency.

As a result, the price of DOGE shot up by 35%, causing a stir in the crypto community.

This is not the first time that Musk has influenced the value of DOGE through his social media activity, with his tweets and comments about the digital asset often causing significant price movements.

Bitcoin Sees Positive Growth Amidst Banking Crisis and Lower Interest Rates

The cryptocurrency market has been performing well recently, and many people are optimistic about it. Bitcoin, the most valuable cryptocurrency, has increased by approximately 70% this year and is currently valued at over $28,000.

It saw a rise of about 20% in March, the largest increase since January 2023. As of now, the global crypto market capitalization is $1.17 trillion, up 1.09% in the last 24 hours.

However, the current surge in the cryptocurrency market could be attributed to the ongoing banking crisis, which has led the Federal Reserve to retract from rate hikes.

When interest rates are high, investors tend to avoid risky assets like cryptocurrencies. However, with falling interest rates, more people are considering investing in Bitcoin.

In general, investors tend to turn to alternatives such as cryptocurrencies during times of financial uncertainty or instability in traditional banking to ensure their financial security and stability.

This provides people with an alternative to the traditional banking system to maintain their financial independence.

Ethereum’s Shanghai Upgrade

Ethereum is switching to a new Proof of Stake mechanism, which will make the network more secure, quicker, and able to process more transactions. The upgrade is called the Shanghai upgrade and it will switch Ethereum’s way of verifying transactions from using a lot of electricity to using how much Ethereum users hold.

Thereby, this would be better for the environment and makes it easier for individuals to utilise Ethereum. Hence, this will help the ETH to gain further traction.

Bitcoin Investors Cautious – Eyes on Economic Indicators and Macro Factors

This week, investors are paying close attention to U.S. economic releases, with the nonfarm payroll data being the main focus. Traders are looking for any signs of labor-market weakness that could affect the Federal Reserve’s policy.

These incoming data are prompting traders to avoid aggressive bids. Meanwhile, Inflation, financial instability, and regulatory changes might all have an influence on the Bitcoin market and produce major price fluctuations.

Bitcoin Price

Bitcoin’s price is experiencing a downward correction from the $28,800 area. If there is a definitive move below the $27,500 support, BTC could see increased bearish momentum. The cryptocurrency managed to rise above the $28,500 resistance level, but struggled to accelerate towards the $28,800 and $29,000 levels.

Immediate resistance is situated around the $27,820 level, near the 23.6% Fib retracement level of the downward movement from the $28,595 swing high to the $27,578 low. The next key resistance is around the $28,100 zone and the trend line, close to the 50% Fib retracement level of the downward movement from the $28,595 swing high to the $27,578 low.

If Bitcoin’s price cannot surpass the $28,100 resistance, it may initiate another decline. Immediate downside support is around the $27,600 zone. The following major support is near the $27,500 zone. If the price breaks below the $27,500 support, it could trigger a new decline. The subsequent major support is around the $27,000 level, below which the price might test the $26,600 level.

Buy BTC Now

Ethereum Price

Ethereum’s price remained robust above the $1,750 support zone. ETH ascended and tried to break through the $1,840 resistance zone, but unlike Bitcoin, it didn’t manage a clear move above $1,840.

The price reached as high as $1,828 before experiencing a downward correction. While it fell below the $1,800 level, the price remained above the $1,750 support zone. A low was established near $1,762, and the price is now climbing.

If Ethereum fails to surpass the $1,825 resistance, it may initiate a downward correction. The first support on the downside is close to the $1,785 level and the trend line.

Buy ETH Now

Top 15 Cryptocurrencies to Watch in 2023

Keep yourself informed about the latest ICO projects and altcoins by frequently referring to the handpicked selection of the 15 most promising cryptocurrencies to monitor in 2023, which has been suggested by the specialists at Industry Talk and Cryptonews.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

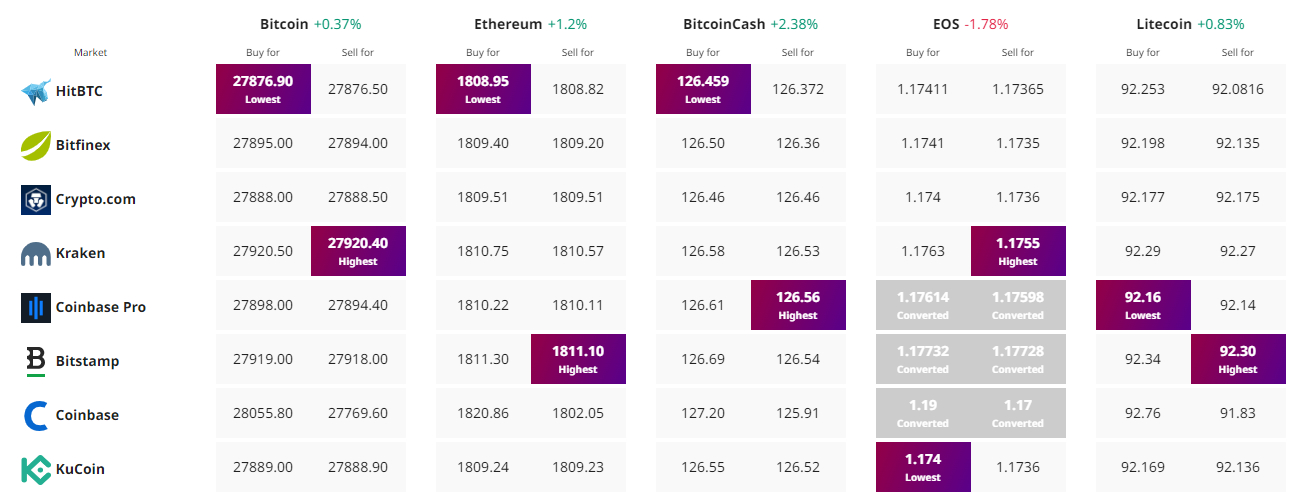

Find The Best Price to Buy/Sell Cryptocurrency