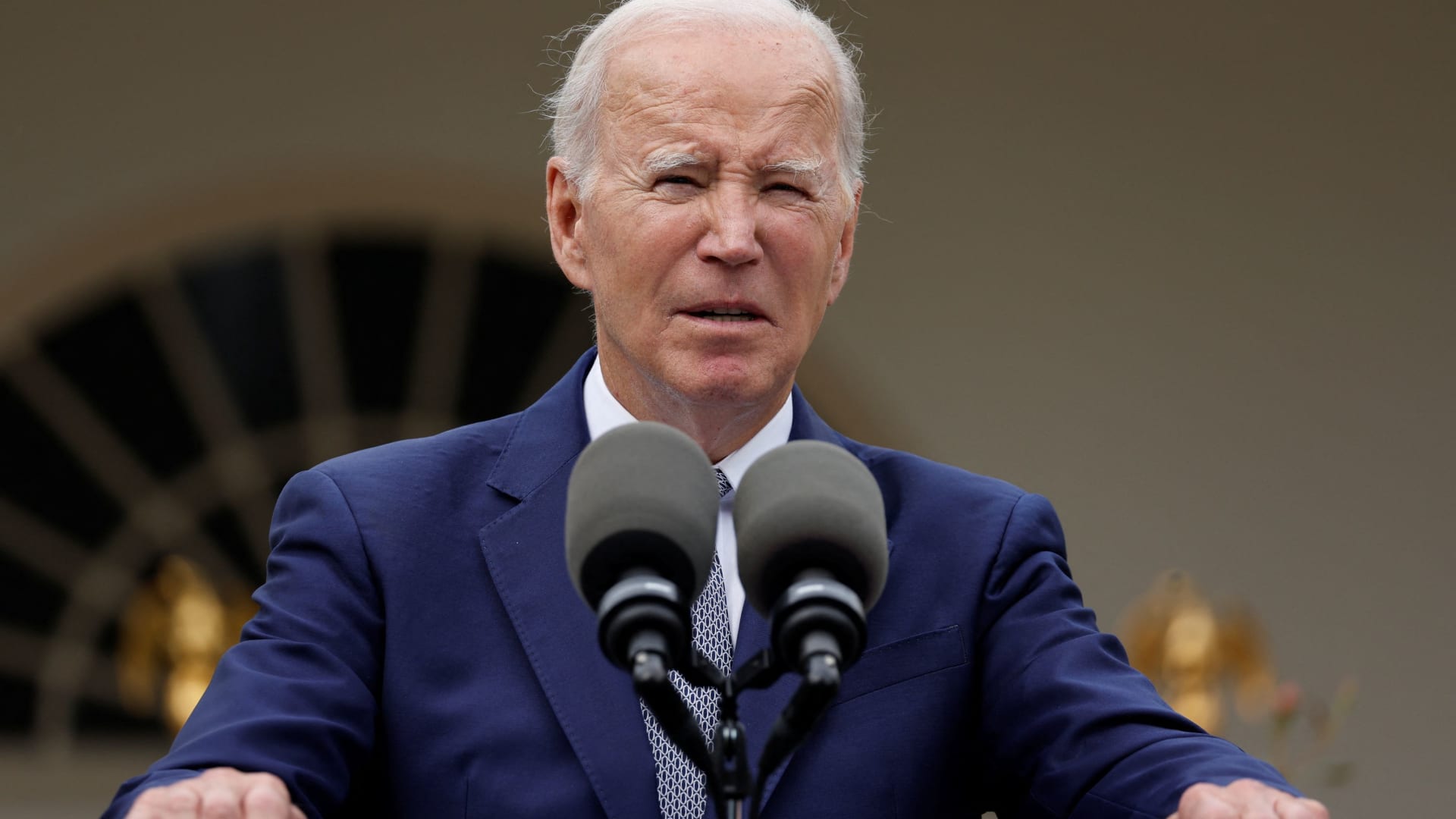

WASHINGTON — President Joe Biden on Tuesday asked Congress in a social media post to fund the government as warnings grew that a looming shutdown could harm the U.S. credit rating and dollar.

Biden in a video reminded Americans of the budget deal he cut with congressional Republicans in the spring to keep government programs operating, while cutting the deficit more than $1 trillion over the next decade.

“There’s a small group of extreme House Republicans who don’t want to live up to that deal,” Biden said in the video, posted on X, formerly known as Twitter.

“So they’re determined to shut down the government, shut it down now and it makes no sense,” the president said. “I’m prepared to do my part, but the Republicans in the House of Representatives refuse.”

“They refuse to stand up to the extremists in their party, so now everyone in America could be forced to pay the price,” Biden said.

Funding appropriation for federal government operations is set to expire Saturday, leaving just days for Congress to pass all 12 appropriations bills and Biden to sign.

The Republican-led House has only managed to pass one such bill.

Failure to pass the remaining bills would cause federal workers to be furloughed, agencies to shutter and place many essential programs in peril.

The White House last month asked Congress to pass a continuing resolution to keep the budget at current levels and allow the government to remain open while negotiations continue.

Leaders of both parties in the Senate have expressed support for that. But extremists in the House reject the idea.

Moody’s and Wells Fargo warned this week a shutdown would negatively affect the U.S. economy.

Moody’s, the only major credit rating agency to still give U.S. sovereign credit a top AAA rating, on Monday said a shutdown would affect that rating.

Another major credit rating agency, Fitch, last month downgraded the U.S. long-term foreign-currency issuer default rating.

“A shutdown would be credit negative for the U.S. sovereign,” Moody’s analysts wrote in a note.

“While government debt service payments would not be impacted and a short-lived shutdown would be unlikely to disrupt the economy, it would underscore the weakness of US institutional and governance strength relative to other AAA-rated sovereigns that we have highlighted in recent years.”

Moody’s added, “In particular, it would demonstrate the significant constraints that intensifying political polarization put on fiscal policymaking at a time of declining fiscal strength, driven by widening fiscal deficits and deteriorating debt affordability.”

Wells Fargo analysts in a note Tuesday said a shutdown could lead to the U.S. dollar index falling between 1% and 1.5% in the upcoming weeks.

“A potential U.S. government shutdown that could start October 1st looms, the chances of which are more or less seen as a coin flip at this point,” Wells Fargo analysts wrote.

“Should a shutdown transpire, there could be a negative impact of the U.S dollar, albeit one that is likely to be modest and short-lived.”