Is It Too Late to Buy Bitcoin? Expert Analysis

Disclaimer: The Industry Talk section features insights from crypto industry players and is not a part of the editorial content of Cryptonews.com.

Bitcoin remains the world’s largest cryptocurrency, with millions of people globally now holding BTC in the hope of generating above-average returns. In many instances, the coin has also solidified itself as a transactional currency, offering another option for shoppers and merchants.

But is it too late to buy Bitcoin? In this article, we take a deep dive into Bitcoin’s price history and examine whether it still has long-term value. We’ll also highlight where traders can buy Bitcoin today with low fees before presenting some alternative cryptos that may be worth considering.

Is It Too Late to Buy Bitcoin? Our Verdict

So, is it too late to invest in Bitcoin? Needless to say, Bitcoin isn’t a new cryptocurrency anymore – and could even be considered ‘mature’ within the context of the crypto market. Although this means the coin’s price tends to be less volatile, it also means explosive growth is improbable.

There are many reasons for this, such as Bitcoin’s lack of utility and its outdated (and energy-intensive) mining process. However, the main reason is that market participants already know what they’re getting with Bitcoin – there are no surprises or additional use cases. In turn, there’s no huge ‘rush’ for investors to purchase BTC.

Moreover, Bitcoin is now widely adopted by institutional investors, which has helped dampen volatility. The coin is now used in various crypto index funds, although the long-awaited spot BTC ETF remains unavailable, despite numerous applications from the likes of investment giants BlackRock and Fidelity in recent months. The adoption by financial institutions does have its good points, yet it also hints that Bitcoin’s quadruple-digit growth is a thing of the past.

Putting everything together, is Bitcoin a good investment? For ‘mom and pop’ investors who are looking to gain exposure to digital currencies for the first time, BTC can represent a suitable option. However, for investors that seek high returns and are happy to take on additional risk, there are certainly better options out there.

Bitcoin Price History

People often ask, “Is Bitcoin still worth investing in?” yet fail to understand the coin’s price history – which can help inform future price moves. For those unaware, Bitcoin was founded by the mysterious Satoshi Nakamoto back in 2008, with the coin’s source code released in early 2009.

In its first few years, many viewed Bitcoin as a joke, with its only real adoption coming from underworld websites like Silk Road. Since Bitcoin payments need no intermediary, both parties can remain anonymous, resulting in BTC gaining a reputation for facilitating murky transactions.

BTC’s value began rising in the early 2010s, and between 2013 and 2014, the coin’s price soared by over 5,600%. At this point, the investment community started taking notice, leading to the formation of many of the top crypto exchanges we see today.

As a beginner crypto, Bitcoin has maintained ‘first-mover’ status within the market, adding credibility in investors’ eyes. Between 2014 and 2020, Bitcoin had several bull runs, which were immediately followed by bearish retracements. However, this all changed in March 2020 at the onset of the COVID-19 pandemic.

Between March 2020 and April 2021, Bitcoin’s price rocketed by 1,537%. After a pullback in the months that followed, the price of BTC soared once more towards the end of 2021. As noted by CoinMarketCap, the Bitcoin’s price reached an all-time high of $68,879 – yet this high was short-lived.

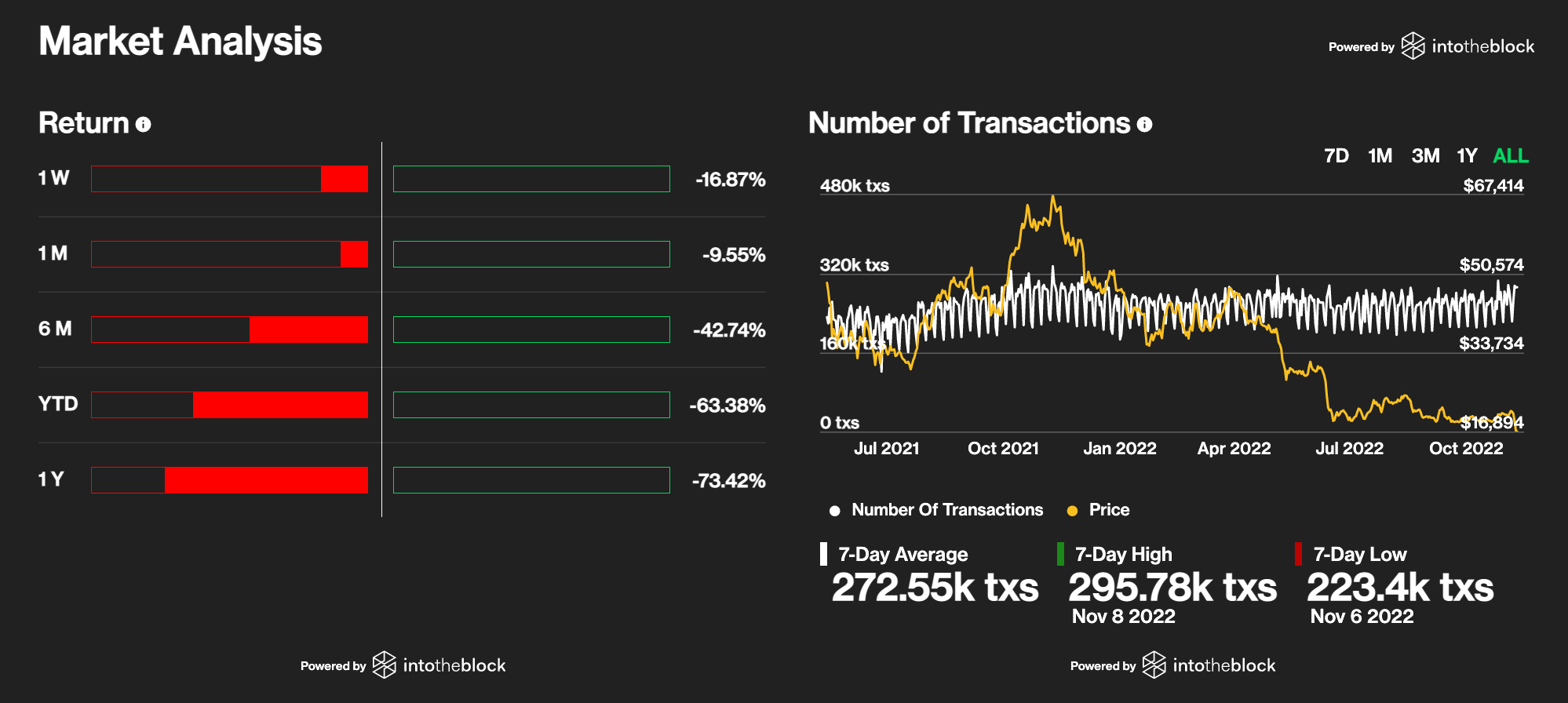

In 2022, after a steep uptrend, BTC saw an accelerated downturn that led the coin to test the $16.2k support level.

This year, however, the bulls have stepped in to regain some momentum and the coin was up by over 90% from July 22 to July 23, almost reaching $32k, although it has since dropped a bit and is trading at around $28.5k at press time.

The following section will see us focus on Bitcoin’s performance in 2023. However, summarized below are BTC’s highs and lows from its inception until today:

- High of $19,735 in December 2017 – a 933% increase in five months

- Low of $3,270 in December 2018

- High of $13,910 in June 2019

- Low of $3,881 in March 2020

- All-time high of $68,789 in November 2021 – 1,644% higher than March 2020’s lows

- Current low of $17,330 in November 2022

- Local high of almost $32,000 in July 2023

- Dropped back to $28,500 in August 2023, at the time of writing

How Has Bitcoin Performed in 2022 – 2023?

Is Bitcoin still worth buying in 2023? To answer this question, it’s essential to explore how the coin has performed and whether there have been any seismic changes in its utility.

In early 2023, Bitcoin was still cited as the best crypto to buy according to Reddit. Although the coin’s price had already fallen significantly from November 2021’s highs, investors saw this as just another pullback. However, what was considered a temporary pullback turned out to be an extended downtrend.

Between November 2021 and June 2022, Bitcoin’s value collapsed by over 74%. The main reason for this was the investment community’s prevailing ‘risk-off’ sentiment, driven by record-high inflation and rapidly-increasing interest rates. When these two forces combine, they make volatile assets like Bitcoin much less appealing.

Those looking for the crypto with the most upside began focusing on other projects, which increased Bitcoin’s bearish momentum. This wasn’t helped by large corporate investors like Tesla opting to liquidate significant portions of their BTC holdings. These factors united to create an adverse environment for Bitcoin and its supporters.

The final nail in the coffin for BTC was the liquidity crisis experienced by FTX. Although this crisis wasn’t directly related to Bitcoin, it caused a contagion effect that rippled throughout the crypto market. This led to a broad sell-off, which forced the price of BTC lower.

However, since the start of 2023, the overall market sentiment showed promise as Bitcoin and the altcoin market saw an uptick. Bitcoin gained over 90% from its $16.2k support level, trading at nearly $32k in July 2023.

BTC has since dropped back to around $28.5k, as of the time of writing in mid-August, but a bull run is expected in early 2024 with the next Bitcoin halving fast approaching and institutional interest still high.

Bitcoin Price Prediction 2023-2030

Given the points raised in the previous section, is Bitcoin still a good investment? The answer to this question depends on what investors believe a ‘good investment’ is. However, in our opinion, Bitcoin’s days of rocket ship-like growth are well behind it – meaning those looking for explosive returns may be better off looking elsewhere.

Many people would like to get rich off crypto, yet for this to happen, they’d need to identify a coin capable of producing triple-digit (or quadruple-digit) growth. The saturated nature of the crypto market now means there are endless possibilities for investors, which takes the attention away from Bitcoin.

We believe that Bitcoin can still provide positive returns in the future – just not to the level seen between 2021 and 2022. With that in mind, detailed below are our BTC price predictions for the years ahead, based on both technical and fundamental factors:

- Forecast for End of 2023: We envision the Fed’s hawkish stance to continue into early 2023, making it difficult for BTC to maintain upward momentum. Due to this, we estimate BTC could value $36,000 by the end of 2023.

- Forecast for End of 2024: The coming years should see the crypto market rebound, providing a better environment for Bitcoin’s price to grow. Should this occur, we estimate Bitcoin could value $47,400 by the end of 2024.

- Forecast for End of 2025: For Bitcoin to be the best long-term crypto, we’d need to see wider adoption from financial institutions and more use cases. If this happens, we predict BTC to be valued at nearly $69,000 by the end of 2025.

- Forecast for End of 2030: Although BTC may not be as innovative as it once was, the coin will still benefit from the growth of other projects. Due to this, we estimate Bitcoin’s value to be around $100,000 by the end of 2030.

How Could Bitcoin be Used in the Future?

In mid-2021, an article from CNBC reported that Citi thinks Bitcoin is at a “tipping point” in its life cycle. The global bank went on to say that Bitcoin is standing on the precipice between “mainstream acceptance” and “speculative implosion” – and it’s fair to say that the latter prediction appears more likely, given today’s conditions.

The fact that Citi (and others) have opted to discuss Bitcoin is undoubtedly a good thing for the coin’s prospects. Although BTC may not be the best option for retail investors, it’s the closest to being widely adopted by financial institutions. At the time of writing, several Bitcoin ETFs are now available for trading, offered by leading names like ProShares, VanEck, and Valkyrie.

Investment giants such as BlackRock and Fidelity are among a number of globally recognizable firms that want to offer spot Bitcoin ETFs to their clients and have applied in 2023.

However, one major stumbling block for Bitcoin is the network’s substantial energy requirements. Those looking to invest in the most sustainable cryptocurrency tend to avoid Bitcoin, as the network relies on ‘mining’ to validate transactions. This mining process uses computers that require vast amounts of electricity, which contributes to global warming.

To put this in perspective, an article from Forbes reported that the Bitcoin network consumes more energy per year than the entire country of Norway. This fact has made it difficult for institutions to adopt Bitcoin, as they’d be seen as promoting an environmentally-damaging asset.

But what else could Bitcoin be used for? The coin’s future may lie in being a medium of exchange, and it is already accepted by over 15,000 merchants worldwide. There are many benefits for merchants who accept BTC, such as faster transaction speeds, lower fees, and the ability to send cross-border payments easily.

Considering the points raised above, is it too late to buy Bitcoin? Unlike the best altcoins, Bitcoin struggles from a lack of utility, which has undoubtedly contributed to the bearish sentiment around the coin.

Due to this, we believe that Bitcoin’s huge price movements are a thing of the past. However, for beginner investors looking to gain exposure to the crypto market, Bitcoin is still a viable option due to its accessibility.

What Experts Say on Whether it’s Too Late to Buy Bitcoin

With emerging cryptos now taking centre stage, the market’s attention is gradually shifting away from Bitcoin. However, many experts are still intrigued by the coin’s prospects. Let’s take a closer look at three experts that have discussed Bitcoin in recent times:

Michael Novogratz

Michael Novogratz is the CEO of Galaxy Investment Partners, an investment firm that focuses on the crypto markets. Novogratz is one of the largest investors in the space and reportedly has a net worth of over $1bn.

A recent article by Bloomberg quoted Novogratz as saying it’s “doubtful” that Bitcoin will exceed $30,000 anytime soon. Moreover, Novogratz also noted a lack of institutional capital flowing into the space, hampering Bitcoin’s progress.

Cathie Wood

Cathie Wood is a famous investor and founder of Ark Invest. Ark Invest emerged as one of the world’s most innovative investment firms in 2020, yet its downfall has been dramatic.

Although not directly attributed to Wood, an Ark Invest analyst came out earlier in the year and stated they believe BTC could value more than $1m by 2030. Wood herself has also admitted to purchasing $100,000 worth of Bitcoin, highlighting her bullish stance.

Jack Dorsey

Jack Dorsey is the co-founder of Twitter and co-founder of Block, Inc. – a leading digital payments company. Dorsey is an ardent crypto supporter and has stated his belief in Bitcoin on many occasions.

For example, Dorsey has been quoted as saying that “Bitcoin changes everything” and “The world will ultimately have a single currency, and I believe it will be Bitcoin”. Block, Inc. also offers BTC trading, highlighting Dorsey’s pro-crypto stance.

Where to Buy Bitcoin

Those wondering, “Is it too late to buy Bitcoin?” will now have a clearer understanding of Bitcoin’s plus points – and its downsides. Regardless, many investors will still wish to gain exposure to BTC’s price movements, as it still represents a viable option for portfolio diversification.

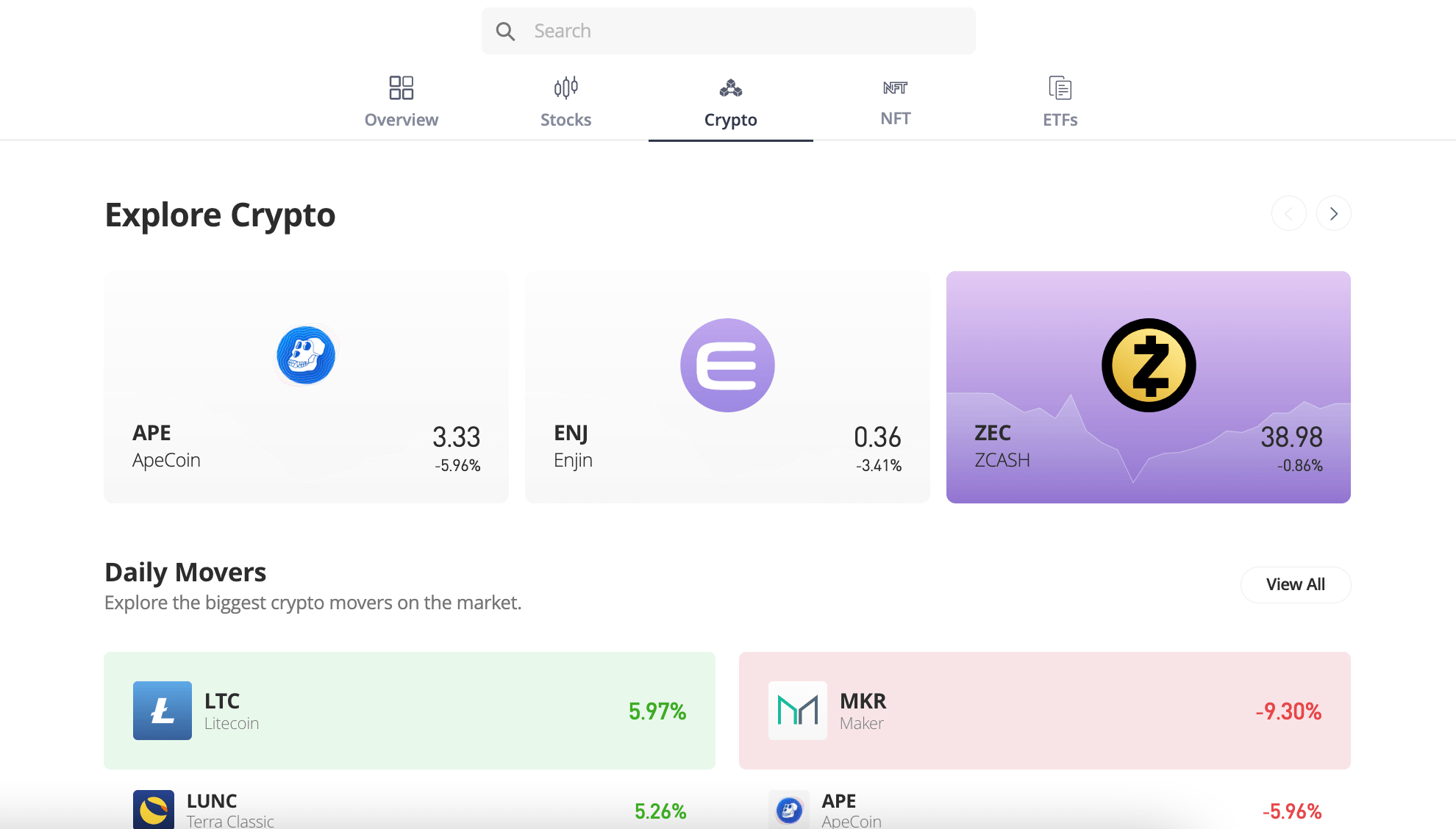

In our experience, one of the easiest ways to buy Bitcoin online is to create an account with eToro. eToro is a huge broker that allows investors to buy a range of assets, including crypto. One of eToro’s best features is its level of safety since the platform is regulated by world-class institutions like the FCA, FinCEN, FINRA, ASIC, and CySEC.

Those looking for the best crypto to trade can partner with eToro, as the platform offers 78 different coins – including BTC. Regarding fees, eToro charges a flat 1% commission on all buy/sell transactions, along with the bid/ask spread. Notably, eToro offers a ‘fractional investing’ approach, meaning clients can invest in BTC from as little as $10.

The trading process itself is streamlined, as clients can use eToro’s browser-based platform or the dedicated mobile app. Both feature real-time price charts, technical indicators, and a variety of order types. eToro even offers a free crypto wallet app incorporating DDoS protection and advanced standardization protocols.

The minimum deposit with eToro is just $10, and users can fund their accounts via credit/debit card, bank transfer, PayPal, Skrill, Neteller, and other e-wallets. Finally, eToro also provides a free demo account facility ideal for beginners seeking risk-free experience in the market.

Buy Bitcoin with eToro

Crypto assets are a volatile investment product. Your capital is at risk.

Is It Too Late to Buy Bitcoin? Our Verdict

Summarizing all of the points raised in this article, is it too late to buy Bitcoin? Given the information presented above, we believe it’s too late to buy Bitcoin for investors seeking exponential returns. The coin is in the ‘mature’ stage of its life cycle, meaning explosive growth is now a thing of the past.

Moreover, Bitcoin has an evident lack of utility compared to projects like Ethereum and Cardano. These projects have smart contract functionality and offer a platform for dApp developers to make their ideas into reality. Bitcoin offers nothing like this, which has damaged its prospects irreversibly.

Although Bitcoin may not be one of the top crypto gainers in the future, it still has a role to play and should be considered as part of a diversified investment portfolio. The coin is the first to be adopted by institutions, likely leading to the spot Bitcoin ETF investors have been seeking. Moreover, BTC has emerged as a viable medium of exchange, which should help maintain a base level of demand.

However, it’s now challenging to back Bitcoin over the long term. The aforementioned lack of utility and its damaging environmental impact create a clear roadblock to progress. For this reason, we believe there are better options for crypto investors, especially those looking to make fast and large gains rather than waiting for an investment to mature.

BTC Halving Impact

Upcoming Bitcoin halving is set for 2024, which will lower the quantity of new BTC tokens entering the market.

This event will cut mining earnings from 6.25 to 3.125 Bitcoin. In the past, halvings have drastically altered Bitcoin’s price. For instance, after the 2012 halving, the price skyrocketed by a staggering 500% percentage. The 2016 halving resulted in a price rise of over 280% in the following months.

Post the 2020 halving, Bitcoin’s value rose by over 500%. Consequently, If the demand for Bitcoin goes up, we could see a significant increase in the value of BTC.

Top analysts at leading investment bank Standard Chartered believe the halving could see the price of BTC rocket to $120,000 by the end of 2024.

Other Bitcoin Alternatives – Bitcoin BSC Is Available for Less Than $1 With Staking Rewards

Bitcoin is one of the most well-established coins and will always have a reputation as the original cryptocurrency. However, it comes with downsides – it can’t experience the upside potential of meme tokens which can skyrocket in short periods of time. In many ways, it has already seen its day. Plus, it operates from an environmentally damaging proof-of-work blockchain, which is also slow and costly.

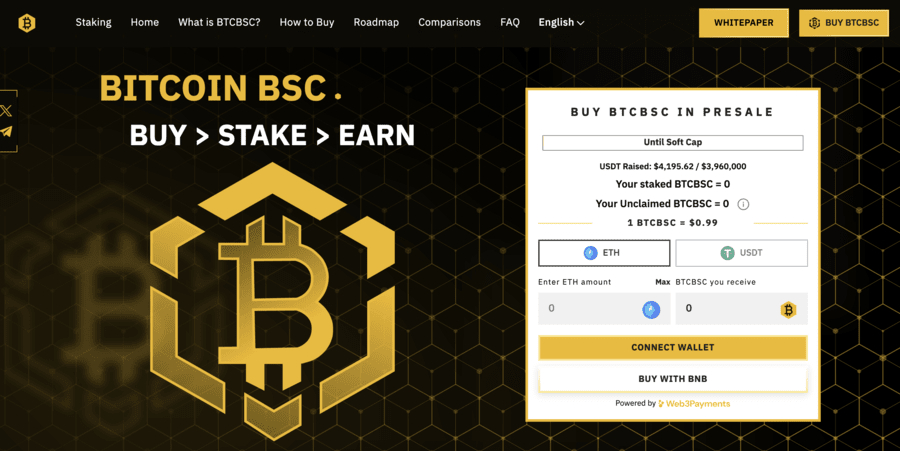

For these reasons, it’s probably a better idea to work with one of the modern Bitcoin models that takes the best attributes, but enhances the token considerably with features desired by investors. One such alternative that does exactly this is Bitcoin BSC ($BTCBSC).

This is a newly launched token that has the exact same tokenomics as Bitcoin – 21 million tokens, priced at $0.99, similar to what Bitcoin was priced at in 2011, with a circulating supply of about 6,125,000. However, aside from the branding and identical token supply and price, this campaign adds to the coin considerably.

It offers staking rewards, and 71% of the total supply is locked for 120 years specifically for this purpose. Rewards are based on the percentage of the staking pool you have contributed, and there is only a 7-day lock period for stakers.

It is built on the BNB Smart Chain, which is proven to be much more efficient and far more cost-effective than many other blockchains, especially Bitcoin. This blockchain also provides security and smart contract functionality.

There is a minimum entry of $10 for this presale, paid for in ETH, BNB, USDT, or Card, In one sense it is not too late to invest in Bitcoin, because there is a new and enhanced version already provided through this presale. On the other hand, it should be kept in mind that this is not Bitcoin, but a separate coin with no official connection.

For more details, please be sure to read the whitepaper, as well as joining the Twitter and Telegram pages.

How Wall Street Memes Can Outperform Bitcoin

Aside from Bitcoin BSC we feel there is one more alternative projects to Bitcoin that could become the next crypto bull run coins.

Let’s take a closer look at the Wall Street Memes projects below – which has been generating massive traction within the crypto community:

Wall Street Memes – New Meme Coin with $25 Million Raised in its Presale

While Bitcoin has historically been the best performing cryptocurrency, in more recent times meme coins have been making all the headlines.

While BTC has risen around 90% during its peak months in 2023, the likes of Pepe coin saw 7,000% gains amid a meme coin frenzy that saw several tokens make incredible returns for early investors.

Bitcoin remains, arguably, the safest crypto bet, but for those investors willing to risk more, there is the opportunity for much higher returns.

Wall Street Memes ($WSM) is one such high-reward project, with the brand new meme token already making waves in the space with its presale.

Just 11 weeks in, the project has already raised $25 million in its presale, with investors impressed by the long track record of success of the developers and their huge social media following.

The project has more than a million followers across its channels, with Elon Musk a known fan of their work – the world’s richest man has interacted with their Twitter page on multiple occasions.

The Wall Street Memes team previously released the Wall Street Bulls NFT collection, which sold out in just 30 minutes in 2021 and has now developed a meme coin.

Set to launch on multiple tier-1 exchanges at the end of September, the presale offers a big opportunity to buy a high-potential token at a low price.

Wall Street Memes also offers staking, meaning investors can generate passive rewards by locking their tokens for a set time. As well as that outcome, it has a further result of incentivizing holding and increasing scarcity in the project – all key factors in driving up price.

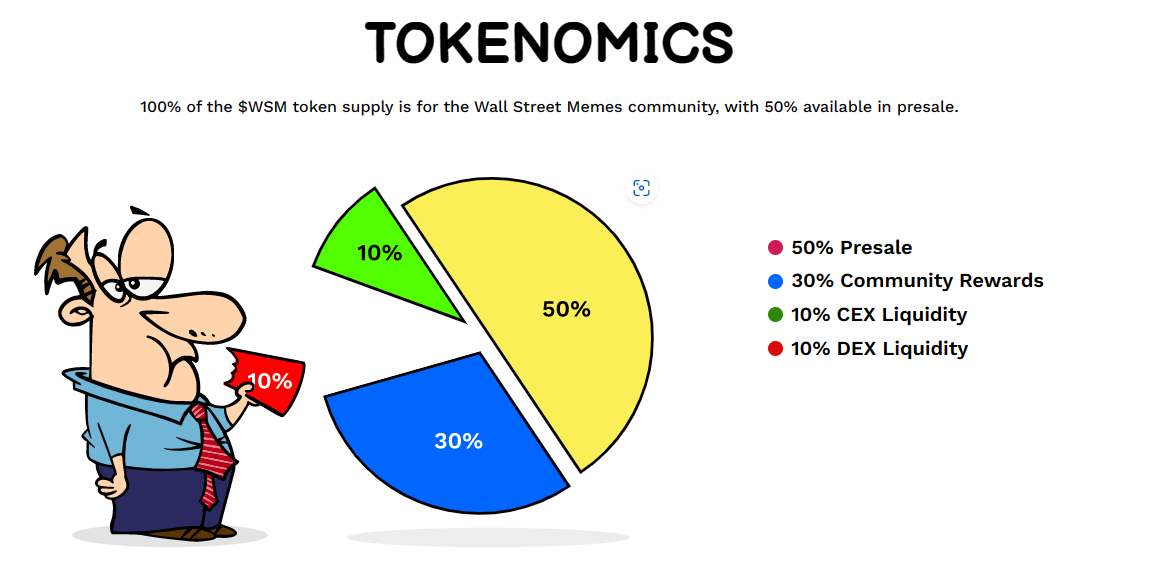

It has a small supply for a meme coin, just two billion tokens, with 50% of those available to purchase during the presale. Another 30% has been reserved for community rewards, which includes an ongoing $50,000 airdrop. The final 20% is for liquidity on exchanges. More information on the project can be found via its Linktree page.

References:

- https://www.bloomberg.com/news/articles/2023-04-24/what-is-bitcoin-halving-and-does-it-push-up-the-cryptocurrency-s-price-q-a

- https://coinmarketcap.com/currencies/bitcoin/

- https://www.cnbc.com/2021/03/01/bitcoin-btc-is-at-a-tipping-point-citi-says.html

- https://www.forbes.com/advisor/investing/cryptocurrency/bitcoins-energy-usage-explained/

- https://www.bloomberg.com/news/articles/2022-08-08/novogratz-doubtful-bitcoin-will-push-through-30-000-soon?leadSource=uverify%20wall

- https://www.ft.com/content/0948f1a9-ad0b-4126-9ae8-5ce4e212c07e

- https://www.reuters.com/technology/standard-chartered-bumps-up-bitcoin-forecast-120000-2023-07-10/

FAQs

Is it too late to buy Bitcoin in 2023?

The question of “Is it too late to buy Bitcoin in 2023?” is asked regularly, and our answer remains the same – it depends on the individual’s unique trading goals. However, if those goals are to generate triple-digit returns in a short space of time, we’d say it’s better to consider other coins.

Is Bitcoin going to go up in value soon?

It’s unlikely that Bitcoin’s value will rise substantially in the short term, as the sentiment around the crypto market is still overwhelmingly bearish. Moreover, the Fed has hinted at further rate increases, which puts even more pressure on risky assets like BTC.

How many years will Bitcoin last?

The last Bitcoin is expected to be mined by 2140, meaning there will be no more mining fees. This would likely make BTC unappealing to these miners, who may look elsewhere – prompting the coin to lose its top-tier status.

Can you still mine Bitcoin?

Yes, it’s still possible to mine Bitcoin. However, custom-built computing systems are now required due to the scale of the Bitcoin network.