Bitcoin Price Prediction: Cathie Wood Backs AI-Bitcoin Link, Clayton Anticipates ETF, & Blackrock’s Buying Rumors Explored

Amidst a swirl of speculation and anticipation, Bitcoin is showing modest gains, trading at $26,028, reflecting a nearly 1% rise as of Monday. Cathie Wood, a notable figure in the investment realm, expresses her bullish stance on the impending merger of Bitcoin with Artificial Intelligence.

Meanwhile, Jay Clayton, the ex-chairman of the SEC, lends weight to the prospects of a Bitcoin ETF securing approval in the near future.

Adding to the fervor, the crypto-community is abuzz with varying theories regarding Blackrock’s rumored Bitcoin buying activities, as discerning fact from fiction becomes the talk of the hour on various social platforms.

Ark Invest’s Cathie Wood Predicts a Promising Future for Bitcoin and AI Convergence

Cathie Wood, CEO of ARK Invest, holds a positive outlook on the convergence of Bitcoin (BTC) and artificial intelligence (AI).

Wood recently shared her optimism through a social media post, highlighting the transformative potential when BTC and AI synergize, benefiting various industries and the overall economy.

This sentiment aligns with ARK Invest’s research document, “Investing In Artificial Intelligence: Where Will Equity Values Surface?,” emphasizing AI’s significance in investment strategies.

It is evident that Wood has a history of investing in AI-related stocks and is enthusiastic about Bitcoin. ARK Invest is pursuing a Bitcoin exchange-traded fund (ETF) and investing in digital assets such as Coinbase and Robinhood.

ARK’s successful AI tech stock strategies, particularly in the ARK Disruptive Innovation ETF, have outperformed the Nasdaq 100 Index with a mid-year profit of 41.2%.

The growing influence of AI in investments, combined with the integration potential of BTC and AI, may reshape corporate operations, enhancing productivity and cost dynamics.

Cathie Wood’s bullish stance could attract more investment into these technologies and potentially boost BTC/USD prices as investors eye the convergence of Bitcoin and AI.

Former SEC Chair Jay Clayton Expects Bitcoin ETF Approval

Former Securities and Exchange Commission (SEC) Chairman Jay Clayton has expressed his belief that the approval of a spot Bitcoin Exchange-Traded Fund (ETF) is “inevitable.”

Clayton’s optimism comes despite the SEC’s delays in approving Bitcoin ETF applications, with several companies, including BlackRock, Ark Invest, Bitwise, WisdomTree, VanEck, and Invesco, seeking approval.

The SEC recently extended its evaluation period for these ETF applications until October 2023. Clayton’s positive sentiments follow a court ruling that the SEC rejected Grayscale’s ETF application as ‘arbitrary and capricious.’

Clayton cited the demand from institutional investors and the growing need for Bitcoin access as key factors driving the inevitability of Bitcoin ETF approval. While he didn’t specify a timeline, he highlighted that it would provide easier cryptocurrency market access for retail traders.

This news and the broader positive sentiment might contribute to the rise in BTC/USD prices today, as investors anticipate greater mainstream acceptance of cryptocurrencies through a potential ETF approval.

Social Media Abuzz with Theories about BlackRock’s Alleged Bitcoin Buying Spree – What’s the Truth?

In the past week, the U.S. Securities and Exchange Commission (SEC) delayed approval for seven spot Bitcoin exchange-traded funds (ETFs), including BlackRock’s proposed iShares Bitcoin Trust.

Meanwhile, Into The Block data shows that from August 13 to the 31st, significant Bitcoin holders, often called ‘whales,’ increased their holdings by $1.5 billion.

This accumulation coincided with Bitcoin’s price dip and the SEC’s decision to postpone several ETF applications until October, a delay that hasn’t dampened optimism among ETF experts anticipating eventual approval.

On social media platforms and forums like X and Reddit, a growing buzz suggests that BlackRock may be secretly accumulating substantial amounts of Bitcoin.

Speculations abound, with posts and claims gaining popularity, but concrete evidence of such acquisitions remains elusive.

Today, BTC/USD is rising, potentially reflecting continued interest in Bitcoin amid these speculations.

Bitcoin Price Prediction

In a recent technical analysis, Bitcoin hints at a mild upward trajectory, particularly after its rally from the pivotal $25,400 support level.

Currently, Bitcoin is inching towards the vital support of $25,400, a level highlighted by its lowest dip on August 22.

The odds of an extended downturn appear high, driven by a bearish engulfing candlestick observed on the four-hour chart, amplified by a negative crossover transpiring beneath the 50-day exponential moving average.

Both the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) are positioned in a sell territory, emphasizing the potential continuation of a bearish trend. Should Bitcoin breach the $25,400 marker, it might find support around $24,600, with $24,150 acting as a robust foundation.

On the flip side, Bitcoin will likely encounter substantial resistance at $25,900. Overcoming this barrier could pave the way for an ascent to $26,400, possibly stretching to $27,000.

In conclusion, today’s pivotal Bitcoin price to monitor is $25,400, as it promises to be a bellwether for its next moves.

Now, let’s shift our focus to the top 15 cryptocurrencies projected to make headlines in 2023.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

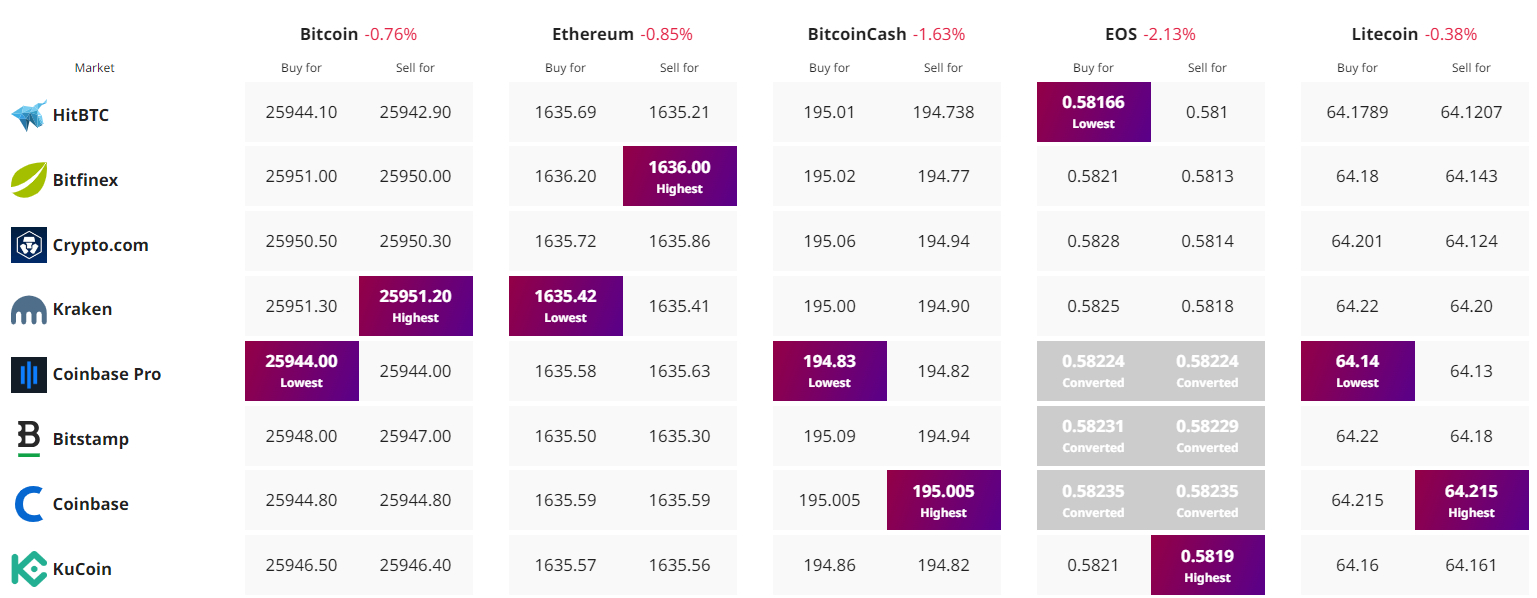

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.