Bitcoin Price Prediction: ETF Likelihood Rises; Robinhood Integration Curbs BTC Losses

Bitcoin maintained a trading level of $27,280 on Thursday, experiencing a slight decrease of less than 1%. The market’s momentum shifted due to a favorable judgment in Grayscale Investments’ Bitcoin ETF lawsuit against the US Securities and Exchange Commission (SEC).

This led to a partial retracement of the gains achieved on Wednesday. This legal victory has garnered attention from Bloomberg analysts, who are now raising the probability of an approved Bitcoin Exchange-Traded Fund (ETF).

Alongside this development, the integration of Bitcoin into Robinhood Wallet is proving to be a valuable asset in mitigating losses for the BTC/USD pair.

This article delves into these crucial events and their potential impact on the Bitcoin price trend.

Bloomberg Analysts Raise Probability of Bitcoin ETF Approval after Grayscale’s Legal Victory

In a significant development, the US District Circuit Court’s approval of Grayscale’s appeal to convert its Bitcoin Trust (GBTC) into a spot Bitcoin Exchange-Traded Fund (ETF) on August 29 has caught the attention of Bloomberg Intelligence analysts.

They have increased the likelihood of an approved spot Bitcoin exchange-traded fund (ETF) by the end of 2023 to 75%, up from the previous estimate of 65%.

This adjustment comes after Grayscale’s recent legal success against the federal securities regulator, which showcased the decisive stance taken by the United States Court of Appeals Circuit.

The analysts from Bloomberg noted that the court’s unanimous rejection of the SEC’s arguments and the upcoming deadlines will likely compel the agency to struggle in denying further approvals.

Moreover, Bloomberg’s James Seyffart predicted that spot Bitcoin ETF approvals could become a “done deal” by Q4 2024, with approval odds now standing at 95%.

As seven Bitcoin spot ETF applications await initial decisions by the SEC in the next five days, it’s speculated that approval might come unexpectedly rather than through prolonged delays. Despite this optimistic prediction, BTC/USD is declining today.

Robinhood Wallet’s BTC Integration Helps Users Limit BTC/USD Losses

Robinhood Markets Inc. has expanded its crypto wallet’s support, including bitcoin (BTC) and dogecoin (DOGE), broadening its reach beyond the Ethereum ecosystem.

The company revealed that all users of the Robinhood wallet could engage in BTC and DOGE transactions, marking a departure from its previous limitation to Ethereum-based assets like ether (ETH) and Ethereum tokens.

The six-month-old wallet has gained popularity with hundreds of thousands of users spanning 140 countries.

Responding to customer demand for increased asset diversity across chains, Robinhood has introduced this product expansion.

Additionally, Robinhood has introduced swap functionality, initially available to “select users,” enabling trade between ether and over 200 different assets. The company plans to extend this feature to all users in the coming weeks.

The addition of BTC to the Robinhood wallet has contributed to preventing further losses in the BTC/USD market by increasing accessibility.

Bitcoin Price Prediction

Bitcoin, the leading cryptocurrency, is currently trading with a neutral bias. It is holding just above the $27,000 mark, which is being supported by the 38.2% Fibonacci retracement level. However, if the price of Bitcoin breaks below the 38.2% Fibo level, it could potentially expose the BTC price to the 50% or 61.8% Fibonacci retracement levels that are currently holding around $26,600 or $26,300 respectively.

Alternatively, closing candles above the 38.2% Fibo level of $27,000 could trigger a buying trend towards $28,000 or even higher, around $28,900. Apart from Bitcoin, it is worth keeping an eye on the top 15 currencies that are expected to make waves in 2023.

Top 15 Cryptocurrencies to Watch in 2023

Be up-to-date with the latest ICO projects and alternative cryptocurrencies by regularly browsing our handpicked collection of the top 15 digital assets to watch in 2023.

Our expert team at Industry Talk and Cryptonews has thoughtfully curated this list to provide professional recommendations and valuable insights.

Keep up with the constantly evolving world of digital assets and discover the potential of these cryptocurrencies.

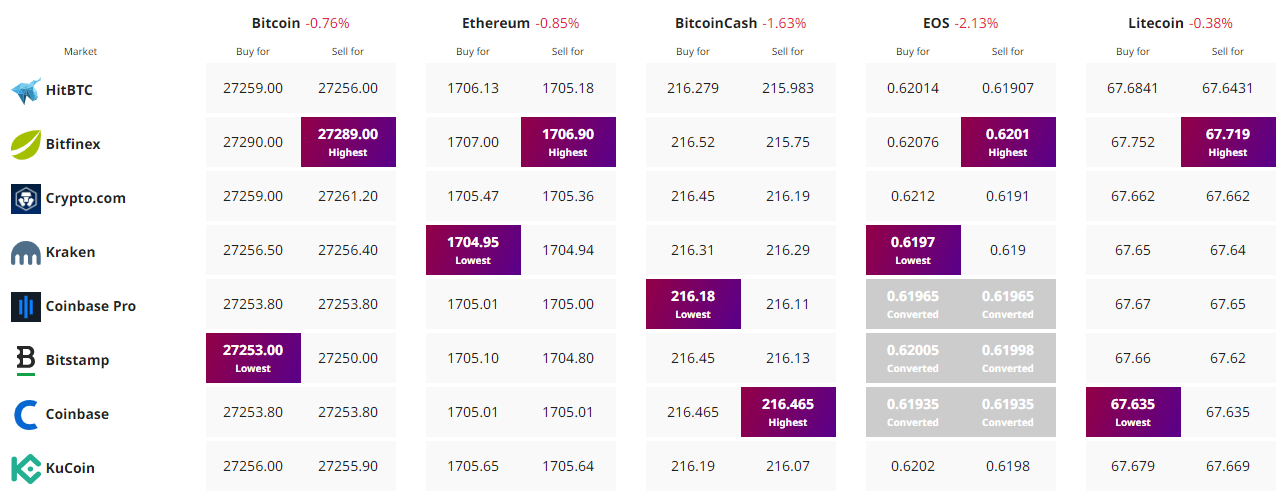

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.