Bitcoin Price Prediction: Former SEC Insider Voices Concerns on BTC ETF Amidst Regulatory Gridlock

As the world of cryptocurrency continues its volatile dance, the BTC/USD pair is currently witnessing a marginal increase, showing gains of nearly 0.10% and trading at a noteworthy $29,442 as of Monday.

Amid this backdrop, recent revelations have stirred the crypto community. A former SEC official has stepped into the limelight, voicing apprehensions regarding approving Bitcoin Spot ETFs.

These concerns, deeply rooted in the current regulatory standstill and evident partisanship, bring to the fore the complexities and challenges the rapidly evolving crypto sector faces.

Former SEC Official Raises Concerns Over Bitcoin Spot ETF Approvals Amidst Regulatory Standstill and Partisanship

Former SEC official John Reed Stark predicts Bitcoin Spot ETF approvals unlikely due to regulatory partisanship, following the postponement of Cathie Wood’s Ark Invest application with a potential decision pushed to 2024.

Stark, who previously worked in the SEC’s internet office, cites “independent and objective experts at Better Markets” to support his viewpoint.

He anticipates a potential shift in crypto regulations following the US presidential elections, particularly if a Republican government takes over.

Stark highlights the impact of political divisions on the commission, noting that this division now extends to the cryptocurrency sphere.

Expert Predicts Potential Advantages for Crypto Industry Under Republican Presidency

Stark highlights potential benefits of a Republican presidency in 2024, such as reduced SEC scrutiny on crypto and a shift towards fraud cases over registration violations.

Moreover, Stark believes a Republican administration would be more inclined to approve a Bitcoin spot ETF and enact other favorable regulatory measures for the crypto industry.

Stark explains the need for a balanced commission, with an equal representation of political affiliations among commissioners, to bridge partisan gaps.

He points out that a power shift could lead to Hester Pierce, also known as the Crypto Mom, assuming an interim leadership role, potentially resulting in decreased regulatory pressures on the crypto sector.

Pierce has a history of advocating for adopting Europe’s MiCA framework and has opposed certain regulatory actions against the crypto industry.

Bitcoin Prices Rise Despite Strong US Dollar

Bitcoin prices rose at the start of the week, but were limited by the strengthening US dollar.

On Monday, the greenback gained nearly 0.15% at 102.98 against major currencies ahead of the Retail Sales data release on Tuesday.

The data is expected to show a 0.4% increase in July compared to June’s 0.2%. The rising USD prices kept BTC gains limited for the day.

Bitcoin Price Prediction

Bitcoin’s support, anchored around the $29,200 mark, remains consistent, with its technical perspective staying unaltered.

At present, Bitcoin displays a neutral trading stance, facing hurdles to break past the $29,600 barrier within a four-hour chart analysis.

Should Bitcoin experience an upward surge surpassing $29,600, there’s potential to ascend to the $30,200 threshold.

Bitcoin has touched a significant Fibonacci retracement level of 61.8%, marking $29,200.

The appearance of doji candlestick patterns above this mark hints at a potential upward correction. However, a decline beneath this point might see a dip to $29,250.

On the flip side, if Bitcoin successfully breaches the $30,200 resistance, it might pave the way to the $30,600-$31,000 bracket.

It’s essential to highlight that the regions of $29,800 and $30,200 are pivotal. Any deviations below these markers might signal a bearish trend for Bitcoin.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

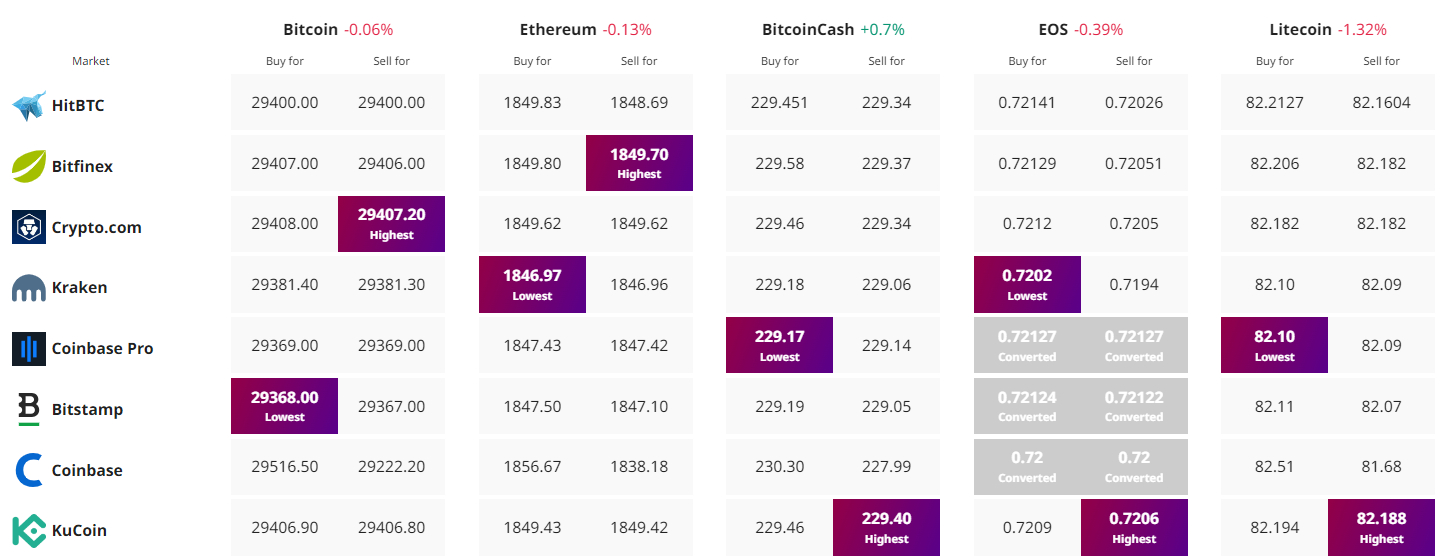

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.