According to an analyst on Twitter, adding just a 2.5% allocation of bitcoin to a portfolio could increase returns by approximately 20%, all while reducing overall risk.

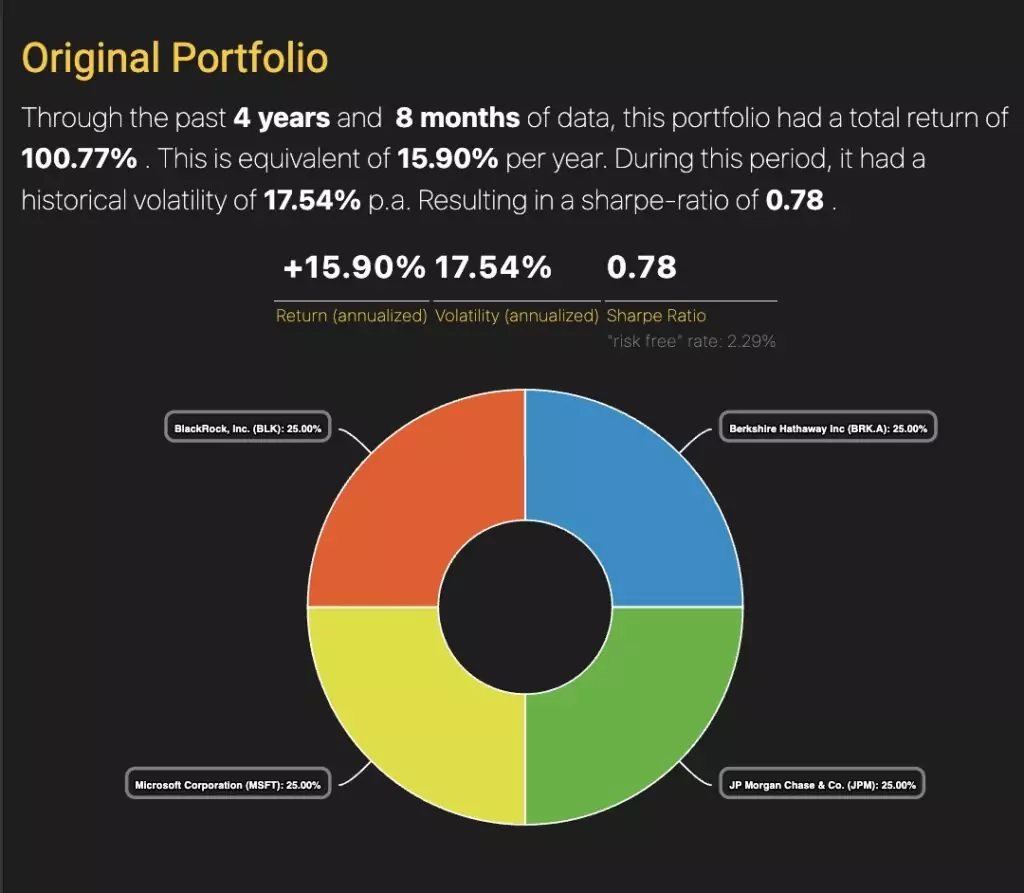

The anonymous analyst considered a portfolio he called the “Rat Poison Portfolio,” comprised of an equally-weighted combination of four major companies: Berkshire Hathaway, Microsoft, JPMorgan, and BlackRock.

He then posed an interesting question; If bitcoin would be introduced to the portfolio, what effects would it have?

“Guess what happens when we add bitcoin to this portfolio?” he added. “Higher volatility? Higher drawdowns? Higher risk?”

He crunched the numbers and came to an intriguing conclusion.

Accordingly, from 2014 onwards the aforementioned portfolio delivered an annualized return of 16%, assuming quarterly rebalancing. However, if we were to allocate 2.5% of the portfolio to bitcoin, we could enhance returns even further, reaching approximately 20% while simultaneously reducing risk.

It might seem counterintuitive, but incorporating bitcoin into the portfolio could have mitigated the drawdown risk of the original portfolio.

“The reason behind this is that bitcoin has an extremely low correlation with the assets in question” he stated. “In other words, the movements of bitcoin’s value are not closely tied to those of the other assets in the portfolio.”

What this means is that when other assets drop in value, generally bitcoin gains value and could compensate for the losses, and surprisingly provide some positive markup, even amid a bear market.

As seen during the recent bear market, bitcoin would have helped reduce the average drawdowns of the portfolio.

He then proposed that in conclusion, it may be worthwhile for individuals like Jamie Dimon and Warren Buffet to assess the potential benefits by running the numbers (but we all know that is not going to happen).

Nevertheless, it’s important to keep in mind that this analysis is based on past data, and past performance is not necessarily indicative of future results.

Bitcoin Is Digital Scarcity

[wpcc-iframe class=”wp-embedded-content” sandbox=”allow-scripts” security=”restricted” style=”position: absolute; clip: rect(1px, 1px, 1px, 1px);” title=”“Bitcoin Is Digital Scarcity” — Bitcoin News” src=”https://bitcoinnews.com/bitcoin-digital-scarcity/embed/#?secret=78qUlNGFH5%23?secret=YmYLdvuPpo” data-secret=”YmYLdvuPpo” width=”600″ height=”338″ frameborder=”0″ marginwidth=”0″ marginheight=”0″ scrolling=”no”]